NEW SALES – Pending (Ratified contracts) – There were 1,266 new written sales in November 2024, a. predictor of future closed sales, which was up 12% versus November of 2023. YTD was up 3.6% at end of November. However, last week saw 167 properties go under contract market wide, down -15% to the same week last year.

CLOSED SALES – There were 1331 closed sales in November of 2024, up 3.9% from November of 2023 and up a negligible 0.1% YTD, compared to 2023.

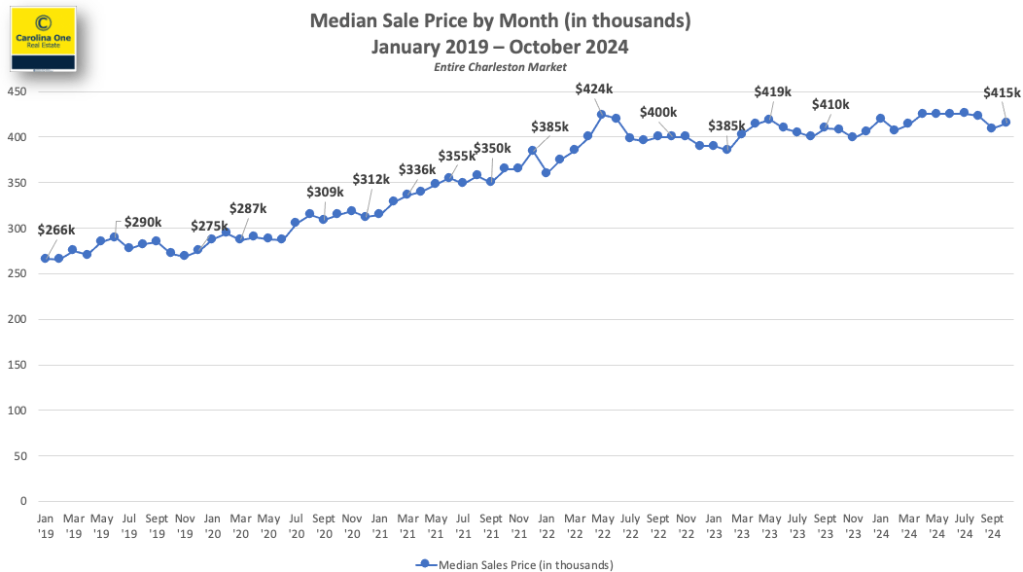

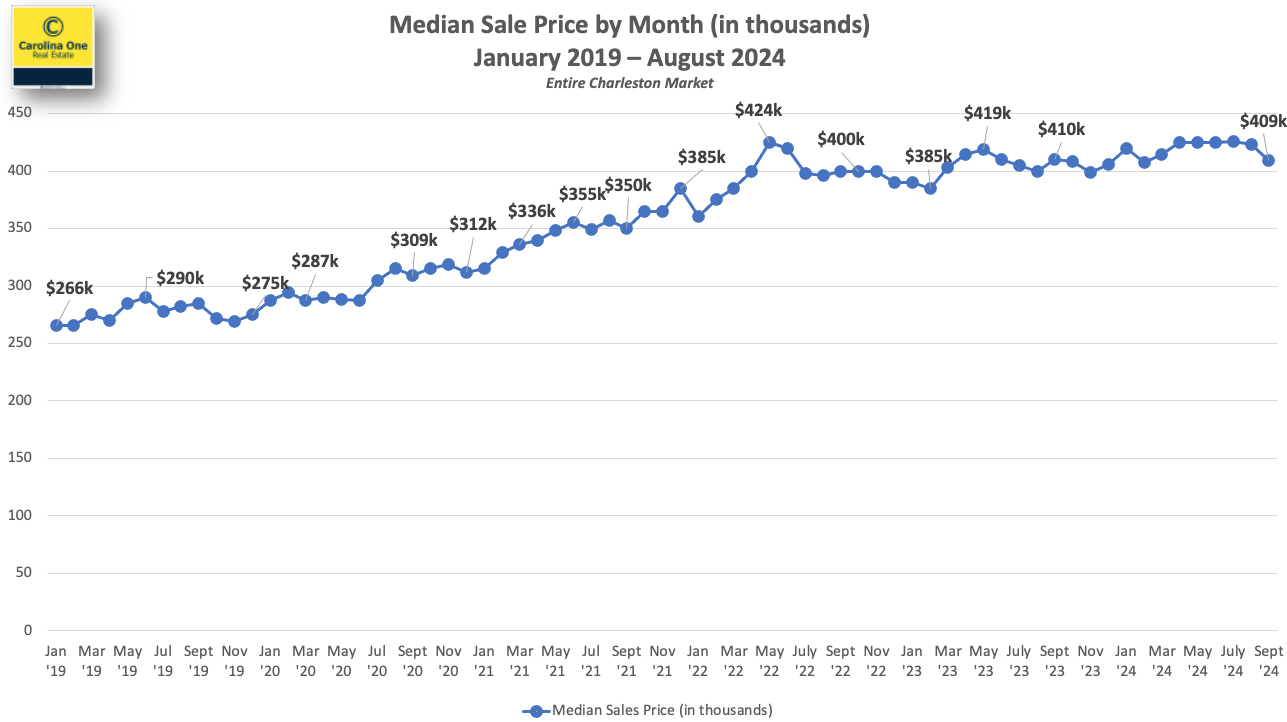

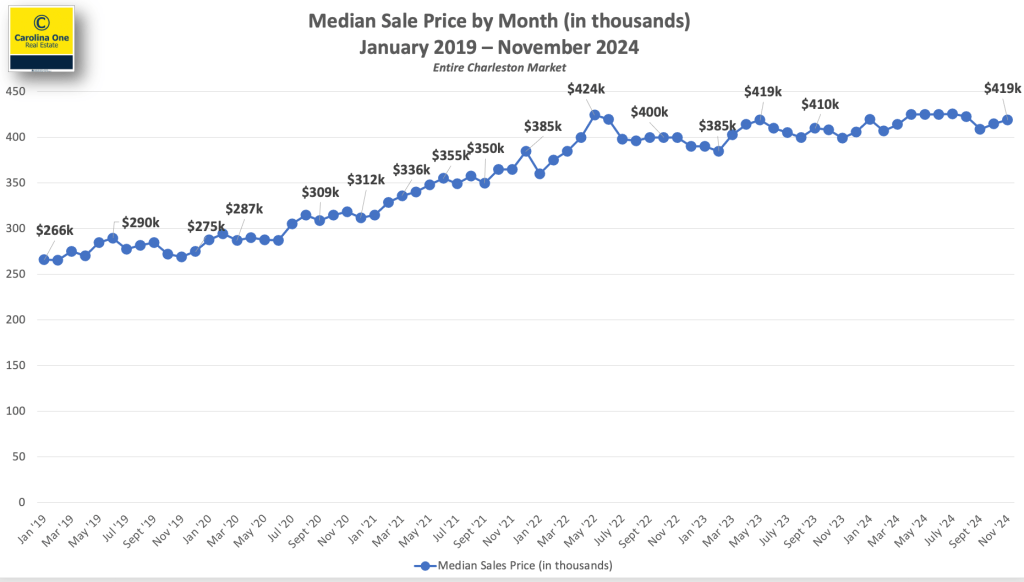

SALES PRICE – The Median sales price closed out at $419,000, up 5.4% over November of 2023 and The Year-to-date median sales price was up 4.25% over 2023. The average sales price for Movember 2024 was $611,213. The Median sale price in the Charleston market continues to stay in a tight band between $400k and $425k where it has been for most of the last 30 months- 2 1/2 years!

AVERAGE SOLD PRICE PER SQFT

The average price per sqft still remains near an all-time high at approximately $286 /sqft

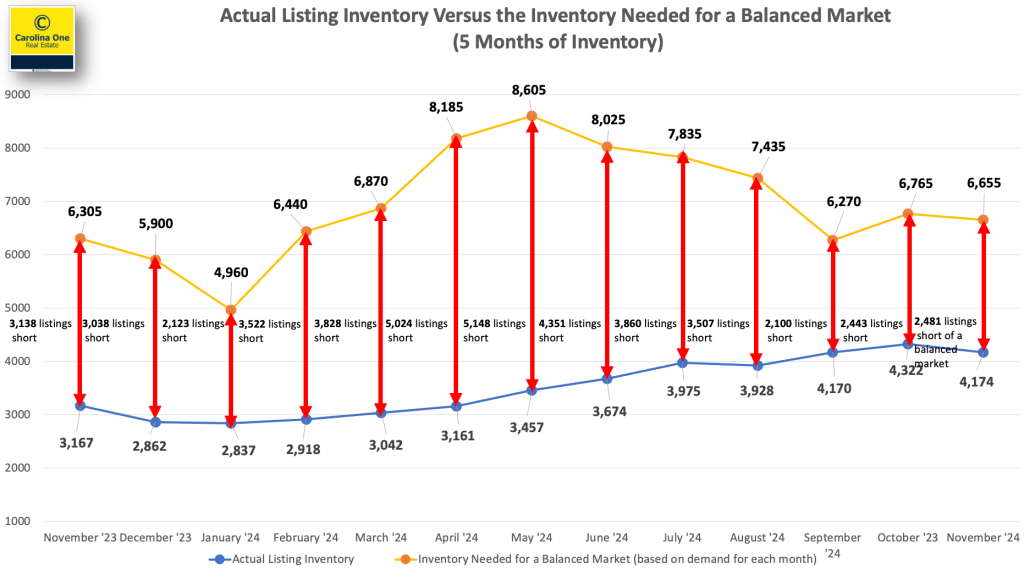

INVENTORY – Approximately 1581 new listings came online in November 2024, which is up 0.6% from November 2023 and up YTD 11.7%

We still need roughly 2,500 additional listings market wide to achieve a balanced market (5 months of inventory)

The market as a whole has approximately 2.6 months of inventory with the Days on Market at 29. See absorption rate by area below:

NEW CONSTRUCTION – New construction represents 49% of all pending contracts in the MLS and new construction comprises approximately 36% of the closings.

FORECLOSURES AND SHORT SALES – Represent a combined 0.7% of all available listings

If you have questions or have a real estate need, please don’t hesitate to contact me!

Thanks,