Chances are at some point in your life you’ve heard the phrase, home is where the heart is. There’s a reason that’s said so often. Becoming a homeowner is emotional.

So, if you’re trying to decide if you want to keep on renting or if you’re ready to buy a home this year, here’s why it’s so easy to fall in love with homeownership.

Customizing to Your Heart’s Desire

Your house should be a space that’s uniquely you. And, if you’re a renter, that can be hard to achieve. When you rent, you don’t have much control over the upgrades, and you’ve got to be careful how many holes you put in the walls. But when you’re a homeowner, you have a lot more freedom. As the National Association of Realtors (NAR) says:

“The home is yours. You can decorate any way you want and choose the types of upgrades and new amenities that appeal to your lifestyle.”

Whether you want to paint the walls a cheery bright color or go for a dark moody tone, you can match your interior to your vibe. Imagine how it would feel to come home at the end of the day and walk into a space that feels like you.

Greater Stability for the Ones You Love Most

One of the hardest things about renting is the uncertainty of what happens at the end of your lease. Does your payment go up so much that you have to move? What if your landlord decides to sell the property? It’s like you’re always waiting for the other shoe to drop. Jeff Ostrowski, a business journalist covering real estate and the economy, explains how homeownership can give you more peace of mind in a Money Geek article:

“Homeownership means you are the boss and have the biggest say in your lifestyle and family decisions. Suppose your kids are in public school and you don’t want to risk having them change schools because your landlord doesn’t renew your lease. Owning a home would remove much of the risk of having to move.”

A Feeling of Belonging

You may also find you feel much more at home in the community once you own a house. That’s because, when you buy a home, you’re staking a claim and saying, I’m a part of this community. You’ll have neighbors, block parties, and more. And that’ll give you the feeling of being a part of something bigger. As the International Housing Association explains:

“. . . homeowning households are more socially involved in community affairs than their renting counterparts. This is due to both the fact that homeowners expect to remain in the community for a longer period of time and that homeowners have an ownership stake in the neighborhood.”

The Emotional High of Achieving Your Dream

You’ll be able to walk up to your front door every day and have that sense of accomplishment welcome you home.

Overview of Benefits – Published by NAR

- Appreciation. Historically, real estate has had long-term, stable growth in value and served as a good hedge against inflation. Census data shows the median price of a home jumped from $172,900 in Q4 2000 to $417,700 in Q4 2023. That’s greater than 6% appreciation per year on average.

- Equity. Money paid for rent is money that you’ll never see again, but paying your mortgage month over month and year over year lets you build equity ownership interest in your home.

- Tax benefits. If you itemize deductions on your federal tax return, the U.S. Tax Code lets you deduct the interest you pay on your mortgage, your property taxes (up to $10,000 according to current tax law), and some of the costs involved in buying a home. Be sure to talk to your accountant to see if it’s advantageous for you to itemize.

- Savings. Building equity in your home is a ready-made savings plan. And when you sell, you can generally exclude up to $250,000 ($500,000 for a married couple) of gain without owing any federal income tax. The IRS provide guidance(link is external) on how to qualify for the exclusion.

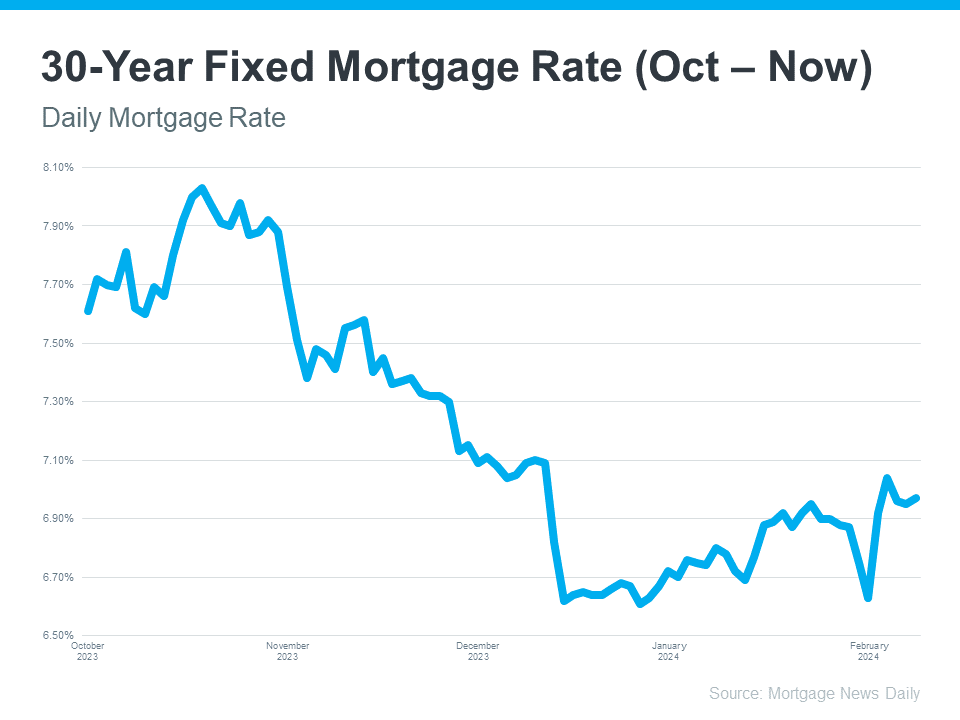

- Predictability. Unlike rent, your fixed-rate mortgage payments don’t rise from year to year. So, as a percentage of your income, your housing costs may actually decline over time. However, keep in mind that property taxes and insurance costs may increase.

- Freedom. The home is yours. You can decorate any way you want and choose the types of upgrades and new amenities that appeal to your lifestyle.

- Stability. Remaining in one neighborhood for several years allows you and your family time to build long-lasting relationships within the community. It also offers children the benefit of educational and social continuity.

A home is a place that reflects who you are, a safe space for the ones you love the most, and a reflection of all you’ve accomplished.

Let’s connect if you’re ready to buy or sell a home!