New Generation of Home Buyers.

Many members of Generation Z (Gen Z) are aging into adulthood and deciding whether to rent or buy a home. If you find yourself in this group, it’s important to understand you’re never too young to start thinking about homeownership. The sooner you start planning, the sooner you can move on from renting.

As you set off on your journey and plan your next move, here are a few reasons to think about homebuying this year.

The Reasons Gen Z Want To Become Homeowners

While the majority of Gen Z haven’t entered the housing market yet, a large portion plan to according to a realtor.com report. The report found that 72% of Gen Z would rather purchase a home than rent long-term. As George Ratiu, Manager of Economic Research for realtor.com, says:

“With nearly three-quarters of those surveyed preferring to buy versus renting long-term, the housing industry should be prepared for millions of Gen Z buyers to bring a new wave of demand along a similar stage-of-life timeline as the millennial generation before them.”

But why do so many members of Gen Z value homeownership? According to the latest Home Buyers and Sellers Generational Trends Report from the National Association of Realtors (NAR), young homebuyers – more than any other age group – want to become homeowners because they want to have a place of their very own.

That may be because one of the biggest benefits of homeownership is having a place that you can truly make your own by customizing it to your style and personality. Whether that’s the décor, painting, or renovations, when you own your home, you don’t have to limit yourself to what your lease and landlord will allow.

Not to mention, owning a home provides much greater long-term stability and security than renting. When you own a home, there’s also protection from steadily rising rental costs because your monthly mortgage payment is locked in for the length of your loan (typically 15 to 30 years).

Work with a Real Estate Professional To Achieve Your Goals

Whether you’re just getting started on your homebuying journey, you want to learn more about the process, or you’re fully committed to buying your first home this year, it’s especially important to connect with a trusted real estate advisor soon, as you won’t be the only first-time buyer in the market. According to a recent survey from realtor.com, a majority of first-time buyers surveyed are looking to purchase a home in 2022. As the survey notes:

“First-time home buyers retain their optimism despite a challenging housing market in the past year. Hoping to achieve their goal of homeownership and provide a comfortable space for their families, young buyers are setting out to learn what they can about the market and setting their list of priorities for their home purchase.”

That means you’ll likely face strong competition from other first-time buyers. One way to get a leg-up on that competition is to work with a real estate professional to make sure you have the support you need to make an informed and confident decision.

Bottom Line

If you’re planning your next move, you’re not alone. Just know it’s never too early to consider the benefits of homeownership over renting. To learn more, contact me!

Gena Glaze 843-343-8239

Filed under Real Estate (Market info)

Why Right Now Is a Once-in-a-Lifetime Opportunity for Sellers

If you’re thinking about selling your house in 2022, you truly have a once-in-a-lifetime opportunity at your fingertips. When selling anything, you always hope for strong demand for the item coupled with a limited supply. That maximizes your leverage when you’re negotiating the sale. Home sellers are in that exact situation right now. Here’s why.

Demand Is Very Strong

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), 6.18 million homes were sold in 2021. This was the largest number of home sales in 15 years. Lawrence Yun, Chief Economist for NAR, explains:

“Sales for the entire year finished strong, reaching the highest annual level since 2006. . . . With mortgage rates expected to rise in 2022, it’s likely that a portion of December buyers were intent on avoiding the inevitable rate increases.”

Demand isn’t expected to weaken this year, either. In addition, the Mortgage Finance Forecast, published last week by the Mortgage Bankers’ Association (MBA), calls for existing-home sales to reach 6.4 million homes this year.

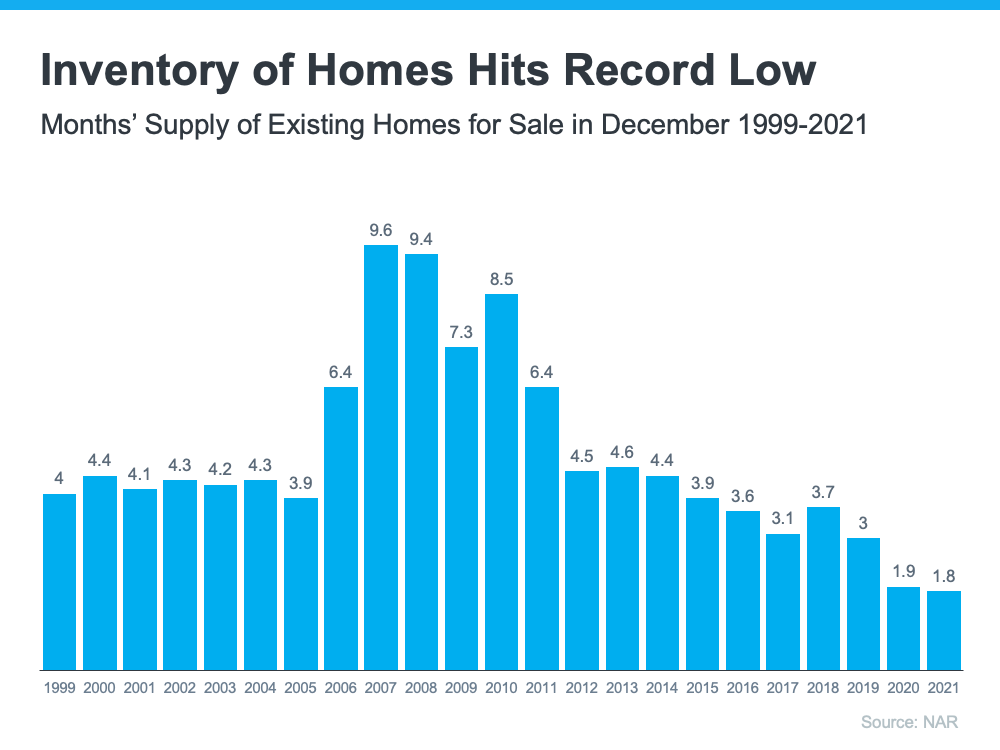

Supply Is Very Limited

The same sales report from NAR also reveals the months’ supply of inventory just hit the lowest number of the century. It notes:

“Total housing inventory at the end of December amounted to 910,000 units, down 18% from November and down 14.2% from one year ago (1.06 million). Unsold inventory sits at a 1.8-month supply at the present sales pace, down from 2.1 months in November and from 1.9 months in December 2020.”

The reality is, inventory decreases every year in December. That’s just how the typical seasonal trend goes in real estate. However, the following graph emphasizes how this December was lower than any other December going all the way back to 1999.

Right Now, Sellers Have Maximum Leverage

As mentioned above, when there’s strong demand for an item and a limited supply of it available, the seller has maximum leverage in the negotiation. In the case of homeowners who are thinking about selling, there may never be a better time than right now. While demand is this high and inventory is this low, you’ll have leverage in all aspects of the sale of your house.

Today’s buyers know they need to be flexible negotiators that make very competitive offers, so here are a few areas that could tip in your favor when your house goes on the market:

- Competitive sales price

- Flexible closing date

- Potential for a leaseback to allow you more time to find a home

- Minimal offer contingencies

Bottom Line

If you’re thinking of selling your house this year, now is the optimal time to list it. Let’s connect to discuss how you can put your house on the market today.

Contact ME if you are thinking of selling!

843-343-8239

gena@genaglaze.com

Filed under Real Estate (Market info)

What It Means To Be in a Sellers’ Market

If you’ve given even a casual thought to selling your house in the near future, this is the time to really think seriously about making a move. Here’s why this season is the ultimate sellers’ market and the optimal time to make sure your house is available for buyers who are looking for homes to purchase.

The latest Existing Home Sales Report from The National Association of Realtors (NAR) shows the inventory of houses for sale is still astonishingly low, sitting at just a 2-month supply at the current sales pace.

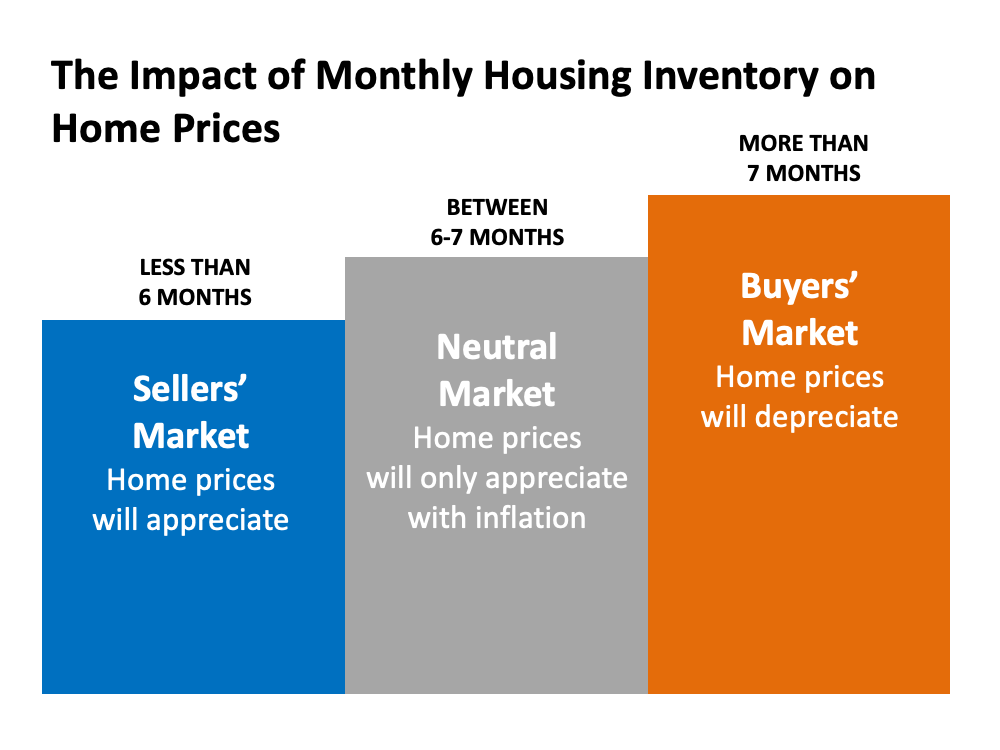

Historically, a 6-month supply is necessary for a ‘normal’ or ‘neutral’ market in which there are enough homes available for active buyers (See graph below):When the supply of houses for sale is as low as it is right now, it’s much harder for buyers to find homes to purchase. As a result, competition among purchasers rises and more bidding wars take place, making it essential for buyers to submit very attractive offers.

As this happens, home prices rise and sellers are in the best position to negotiate deals that meet their ideal terms. If you put your house on the market while so few homes are available to buy, it will likely get a lot of attention from hopeful buyers.

Today, there are many buyers who are ready, willing, and able to purchase a home. Low mortgage rates and a year filled with unique changes have prompted buyers to think differently about where they live and they’re taking action. The supply of homes for sale is not keeping up with this high demand, making now the optimal time to sell your house.

Filed under Real Estate (Market info)

ARE WE IN A HOUSING BUBBLE?

Housing Bubble?

The “warning signs” look all too familiar.

Escalating home prices have both buyers & sellers worried that the market is just “too good to be true,” and agents across the U.S. are getting bombarded with the ultimate question: “Are we in a housing bubble?”

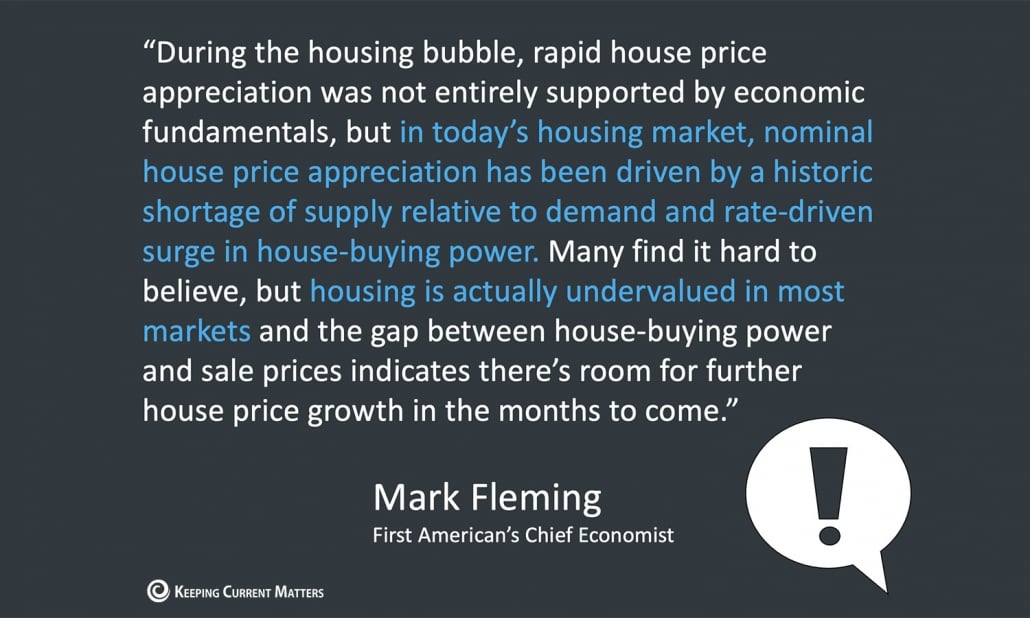

Let’s take a look at 3 key factors that suggest we’re not, so you can educate your clients and calm fears in your market.

Part 1: Housing Supply

Last year, home values appreciated a whopping 10% on average across the country. And while this year’s growth isn’t expected to match it (experts are predicting closer to 5%), buyers and sellers are still worried that home prices are too high and that depreciation is likely to follow.

However, unlike the Housing Bubble years of the mid-2000s, the major factor driving up home values is that we are also in a dire inventory shortage.

A balanced real estate market’s inventory sits around 6 months. Today’s current market is at 1.9 months, a historically low amount of homes for sale. On top of that, inventory has slowly been declining for years now: we’ve been under 5 months inventory for the last three.

In comparison, the inventory level from 2005 and 2007 increased from 5 months to 11 months, a vast over-supply of homes that did not warrant the price appreciation that went along with it.

So, throwing it back to your high school economics class, the biggest driver of price appreciation is a simple case of supply and demand, hence what we’re seeing in the market today.

Part 2: Housing Demand

If you remember the housing boom of the mid-2000s, you know how crazy that time was in real estate. But if Robert Schiller, a fellow at the Yale School of Management’s International Center for Finance, could sum it up in one phrase, it’s this: irrational exuberance.

In other words, the buying and selling frenzy that in-part caused the market collapse was fueled not by tactful, financial decisions but a country-wide case of FOMO (fear of missing out).

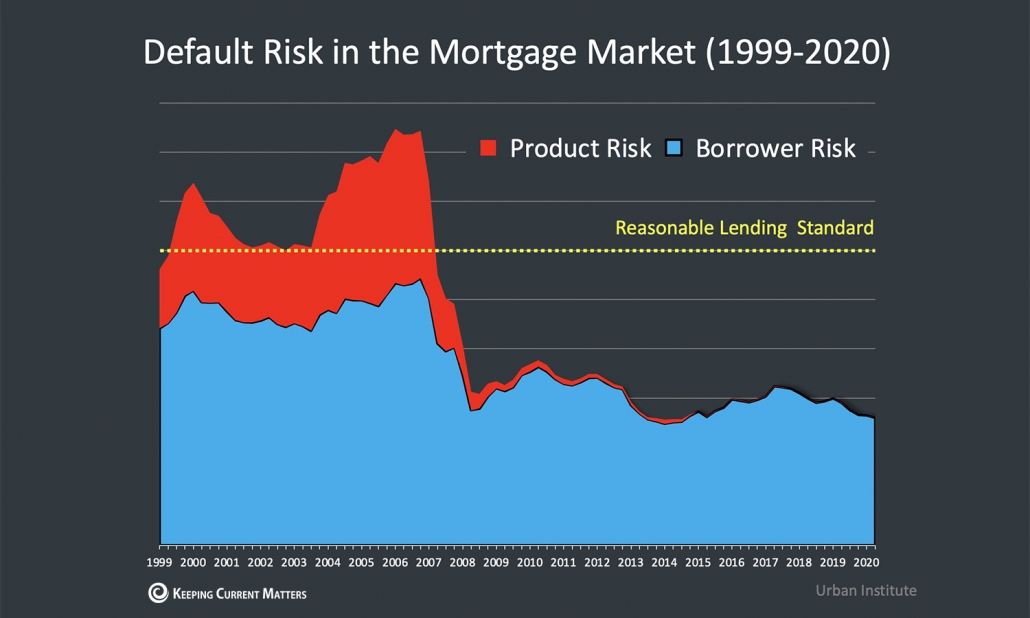

The mortgage industry fed into the frenzy, making it easy for people to obtain home loans much higher than they could afford.

Today’s real estate demand, however, is a very real thing.

Millennials, currently the largest generation in the U.S., are finally ready for homeownership and hitting the market in mass. The health crisis is also challenging homeowners to re-evaluate whether their current home meets their needs, driving more eager buyers into the market.

These two big factors, coupled with historically low mortgage rates, make purchasing a home today a good financial decision. So, not only is the demand very real, it’s also very smart.

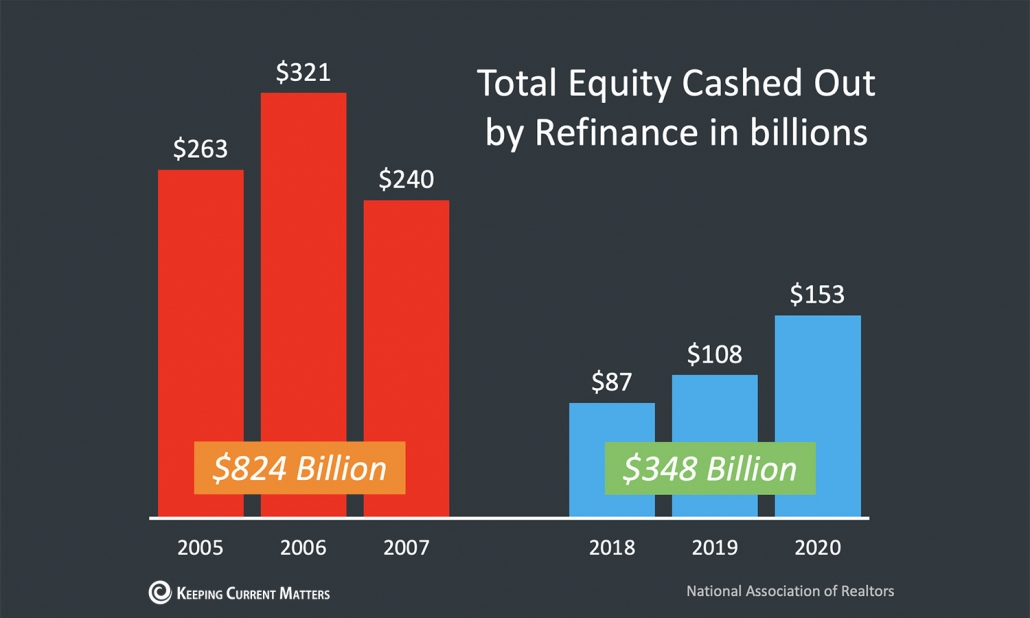

Part 3: Equity

Following the housing and economic crash of 2008, economists, financiers, and real estate industry experts have combed through data to figure out why the entire system crumbled the way it did.

Most will agree that one of the biggest pieces of that catastrophic equation came down to this: equity. Or in reality, a lack of it.

The mid-2000s saw a massive wave of homeowners cashing out the equity in their homes. In short, they were using their homes like ATMs to afford some of the finer things in life.

This led to a lot of negative equity situations: where the amount someone owed on their home was far more than what their house was worth. Many foreclosures and short-sales followed, depreciating home values nationwide.

Today is a much different equity picture. Cash-out refinance volume over the last three years is less than a third of what it was compared to the three years before the crash. More than 38% of homeowners have paid off their mortgage “free and clear,” and another 18.7% have paid off over 50% of their mortgage.

This positive equity perspective puts the current housing market in a much stronger place, minimizing risk of foreclosure and stabilizing home values across the U.S.

Gena Glaze

Filed under Real Estate (Market info)

What Is the Strongest Tailwind to Today’s Recovering Economy?

Last year started off with a bang. Unemployment was under 4%, forecasters were giddy with their projections for the economy, and the residential housing market had the strongest January and February activity in over a decade.

Then came the announcement on March 11, 2020, from the World Health Organization declaring COVID-19 a worldwide pandemic. Two days later, the White House declared it a national emergency. Businesses and schools were forced to close, shelter-in-place mandates were enacted, and the economy came to a screeching halt. As a result, unemployment in this country skyrocketed to 14.9%.

A year later, the economy is recovering, and the U.S. has regained more than half of the jobs that were originally lost. However, some businesses are still closed, and many schools are still struggling to reopen. Despite the past and current challenges, there is one industry that’s proven to be a tailwind helping to counter all of these headwinds to our economy. That industry is housing. Remarkably, the residential real estate market (including existing homes and new construction) has flourished over the last twelve months. Sales are up, prices are appreciating, and more new homes are being built. The housing market has been a pillar of strength in an otherwise slowly recovering economy.

How does the real estate market help the economy?

At the beginning of the pandemic, the National Association of Realtors (NAR) released a report that explained:

“Real estate has been, and remains, the foundation of wealth building for the middle class and a critical link in the flow of goods, services, and income for millions of Americans. Accounting for nearly 18% of the GDP, real estate is clearly a major driver of the U.S. economy.”

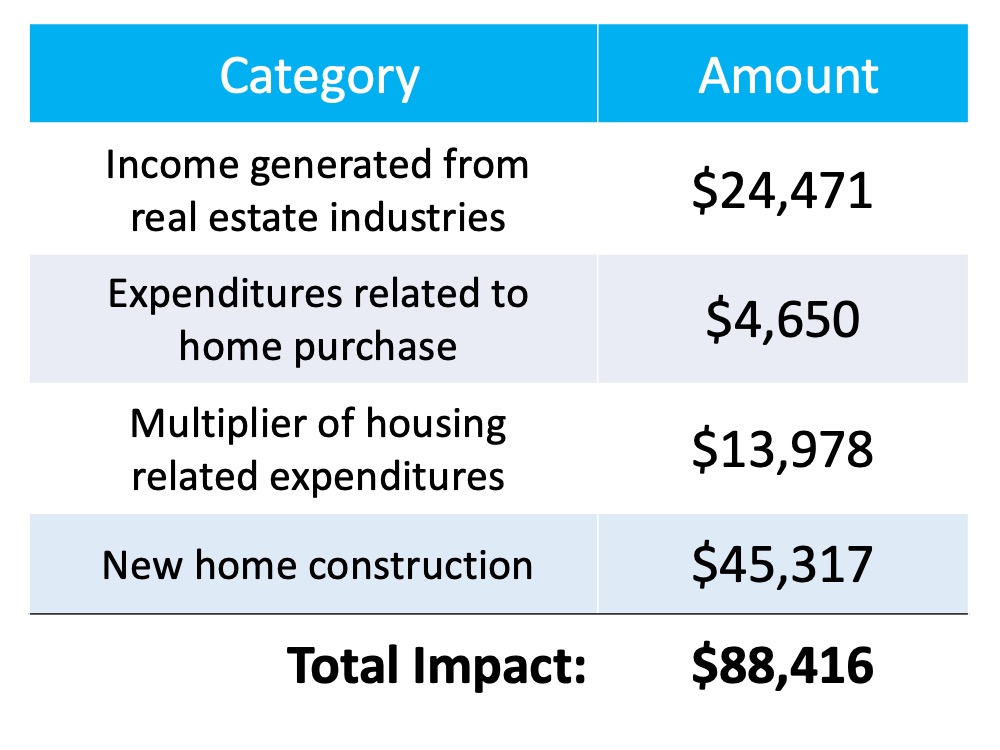

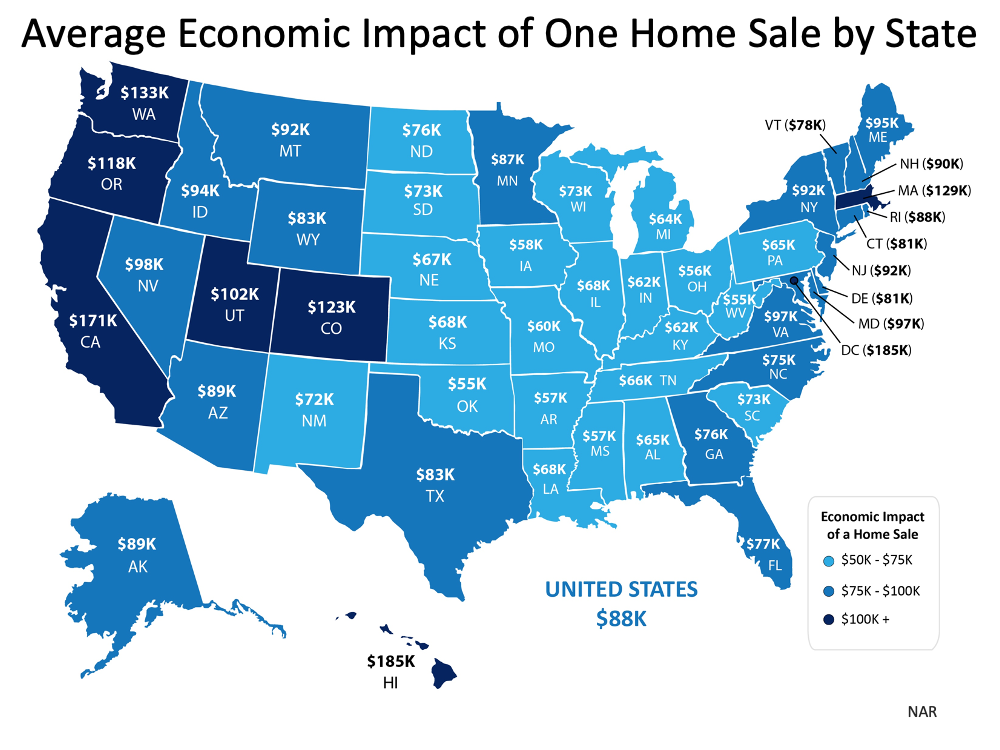

The report calculated the total economic impact of real estate-related industries on the economy as well as the expenditures that resulted from a single home sale. At a national level, their research revealed that a single newly constructed home had an economic impact of $88,416.

Here’s how it breaks down:The map below shows the impact by state:The impact of an existing home sale is approximately $40,000.

Real estate has done more for our economic wellbeing than virtually any other industry over the last year. It’s been a beacon of light during a very challenging time in our nation’s history.

Bottom Line

Whether you’re buying a newly constructed home or one that already exists, you’re making a positive economic impact in your local community – and it’s a step toward your homeownership goals as well.

Filed under Real Estate (Market info)

FORBEARANCE Information

A federal law passed on March 27, 2020, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, puts in place protections for homeowners with mortgages that are federally or Government Sponsored Enterprise (GSE) backed or funded (FHA, VA, USDA, Fannie Mae,Freddie Mac.

The CARES Act provides many homeowners with the right to have all mortgage payments completely paused for a period of time.under the CARES Act, if you have a federally or GSE-backed mortgage, you can request and obtain a forbearance for up to 180 days.

Servicers are obligated to provide a CARES Act forbearance if: (1) a borrower requests forbearance, and (2) the borrower affirms financial hardship due to the COVID-19 emergency.

Keep in mind, the missed payments are still owed, check with your servicer for individual options.

Homeowners with mortgages owned or guaranteed by Fannie Mae or Freddie Mac may be eligible for different repayment options following forbearance. Fannie Mae and Freddie Mac do not require a lump sum payment at the end of the forbearance.

If you can afford to resume your regular monthly mortgage payment you may be eligible for a payment deferral which puts your missed mortgage payments into a payment due at the sale or refinancing of your home, or at the end of the loan.

FHA does not require lump sum repayment at the end of the forbearance. The COVID-19 home retention option, called the COVID-19 Standalone Partial Claim, places amounts you owe into a junior lien that is repaid when you refinance your mortgage or sell your home or your mortgage otherwise terminates. If you do not qualify for the COVID-19 Standalone Partial Claim, FHA offers other tools to help you repay the missed payments over time.

For more information on Federal Housing Administration Mortgages: answers@hud.gov, call 1-800-CALL-FHA (1-800-225-5342), or visit www.hud.gov .

If you have an FHA, VA or USDA loan, check out this fact sheet;

Filed under Real Estate (Market info)

Refinance Will Cost More! – New Adverse Market Fee – Effective Sept.1 2020

Fannie Mae and Freddie Mac announced Wednesday evening that they will now be charging a 0.5% adverse market fee on all refinances, including cash-out and non-cash-out refi’s. This new fee goes into effect Sept. 1.

“As a result of risk management and loss forecasting precipitated by COVID-19 related economic and market uncertainty, we are introducing a new Market Condition Credit Fee in Price,” Freddie Mac said in a notice to lenders.

The Federal Housing Finance Agency, which regulates Fannie and Freddie, said the two government-sponsored enterprises “requested, and were granted, permission from FHFA to place an adverse market fee on mortgage refinance acquisitions.”

The new fee could add up to a significant sum in many cases. The median home nationwide was worth $291,300 as of the second quarter, according to the National Association of Realtors. Therefore, if you applied this fee to a mortgage on a home worth that much, assuming a 20% down payment, the fee would cost over $1,100. The Mortgage Bankers Association, a trade group that represents lenders, said the fee would amount to around $1,400 per loan on average.

“Fannie and Freddie say they’re charging the fee to account for market uncertainty and higher risk,” said Holden Lewis, home and mortgage expert at personal-finance website NerdWallet.

See more News regarding this topic;

Filed under Real Estate (Market info)

Are We About to See a New Wave of Foreclosures?

With all of the havoc being caused by COVID-19, many are concerned we may see a new wave of foreclosures. Restaurants, airlines, hotels, and many other industries are furloughing workers or dramatically cutting their hours. Without a job, many homeowners are wondering how they’ll be able to afford their mortgage payments.

In spite of this, there are actually many reasons we won’t see a surge in the number of foreclosures like we did during the housing crash over ten years ago. Here are just a few of those reasons:

The Government Learned its Lesson the Last Time

During the previous housing crash, the government was slow to recognize the challenges homeowners were having and waited too long to grant relief. Today, action is being taken swiftly. Just this week:

- The Federal Housing Administration indicated it is enacting an “immediate foreclosure and eviction moratorium for single family homeowners with FHA-insured mortgages” for the next 60 days.

- The Federal Housing Finance Agency announced it is directing Fannie Mae and Freddie Mac to suspend foreclosures and evictions for “at least 60 days.”

Homeowners Learned their Lesson the Last Time

When the housing market was going strong in the early 2000s, homeowners gained a tremendous amount of equity in their homes. Many began to tap into that equity. Some started to use their homes as ATM machines to purchase luxury items like cars, jet-skis, and lavish vacations. When prices dipped, many found themselves in a negative equity situation (where the mortgage was greater than the value of their homes). Some just walked away, leaving the banks with no other option but to foreclose on their properties.

Today, the home equity situation in America is vastly different. From 2005-2007, homeowners cashed out $824 billion worth of home equity by refinancing. In the last three years, they cashed out only $232 billion, less than one-third of that amount. That has led to:

- 37% of homes in America having no mortgage at all

- Of the remaining 63%, more than 1 in 4 having over 50% equity

Even if prices dip (and most experts are not predicting that they will), most homeowners will still have vast amounts of value in their homes and will not walk away from that money.

There Will Be Help Available to Individuals and Small Businesses

The government is aware of the financial pain this virus has caused and will continue to cause. Yesterday, the Associated Press reported:

“In a memorandum, Treasury proposed two $250 billion cash infusions to individuals: A first set of checks issued starting April 6, with a second wave in mid-May. The amounts would depend on income and family size.”

The plan also recommends $300 billion for small businesses.

Bottom Line

These are not going to be easy times. However, the lessons learned from the last crisis have Americans better prepared to weather the financial storm. For those who can’t, help is on the way.

Gena Glaze

Contact me for more information!

843-343-8239

Filed under Real Estate (Market info)

![Americans Choose Real Estate as the Best Investment [INFOGRAPHIC] | Keeping Current Matters](https://files.keepingcurrentmatters.com/wp-content/uploads/2022/01/20143424/20220121-NM.png)