| News you can use – Prime Lending Update |

| Update August 26, 2023 |

| •U.S. 10-year Treasury closed at 4.23% on Thursday afternoon •Existing Home Sales came in lower than analyst’s expectations (4.07mm vs expectations of 4.15mm) •New Home Sales came in higher than analyst’s expectations (714k vs expectations of 703k) •Durable Goods came in lower than analyst’s expectations (-5.2% m/m vs expectations of -4.0% m/m) •Initial Jobless Claims came in lower than analyst’s expectations (230k claims vs expectations of 240k claims)•Mortgage Applications fell 4.2% this week |

Market News – 8-26-23 – Overview

Filed under Real Estate (Market info)

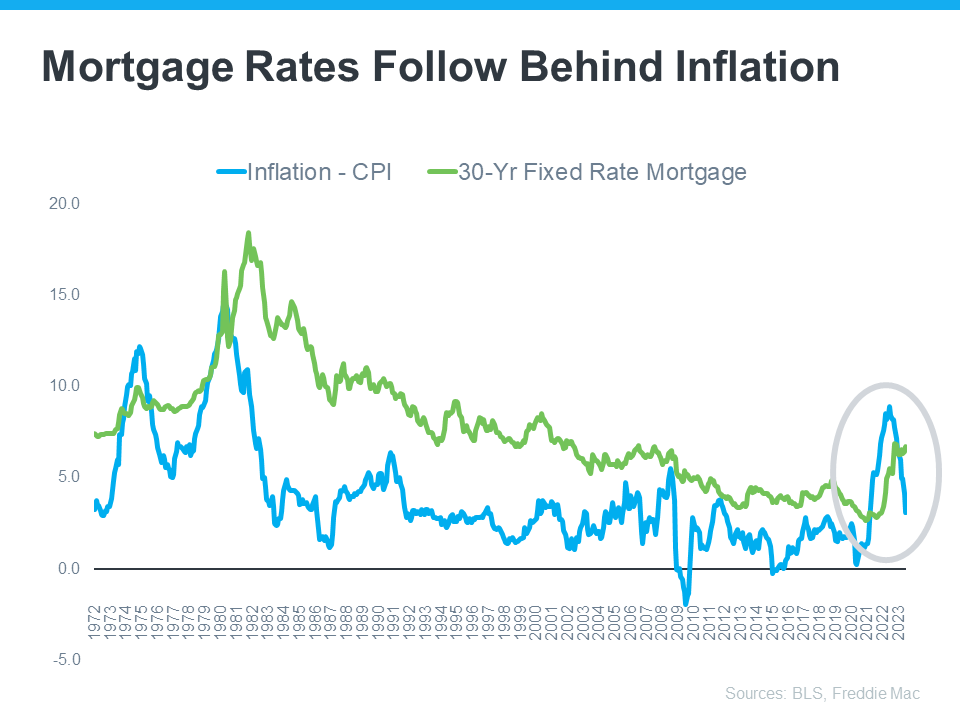

How Inflation Affects Mortgage Rates

When you read about the housing market in the news, you might see something about a recent decision made by the Federal Reserve (the Fed). But how does this decision affect you and your plans to buy a home? Here’s what you need to know.

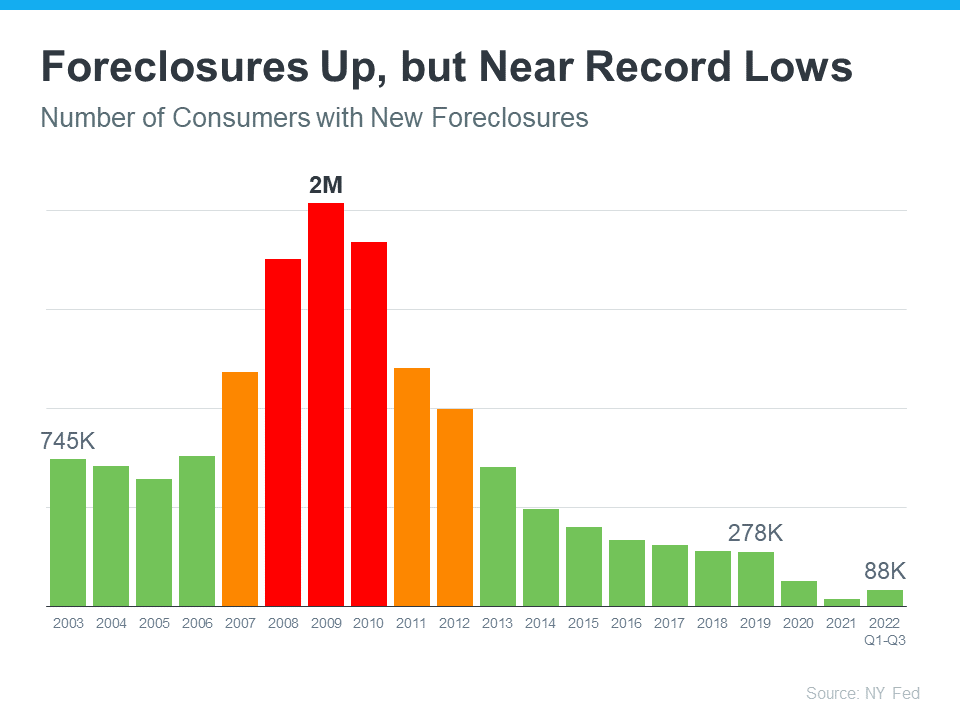

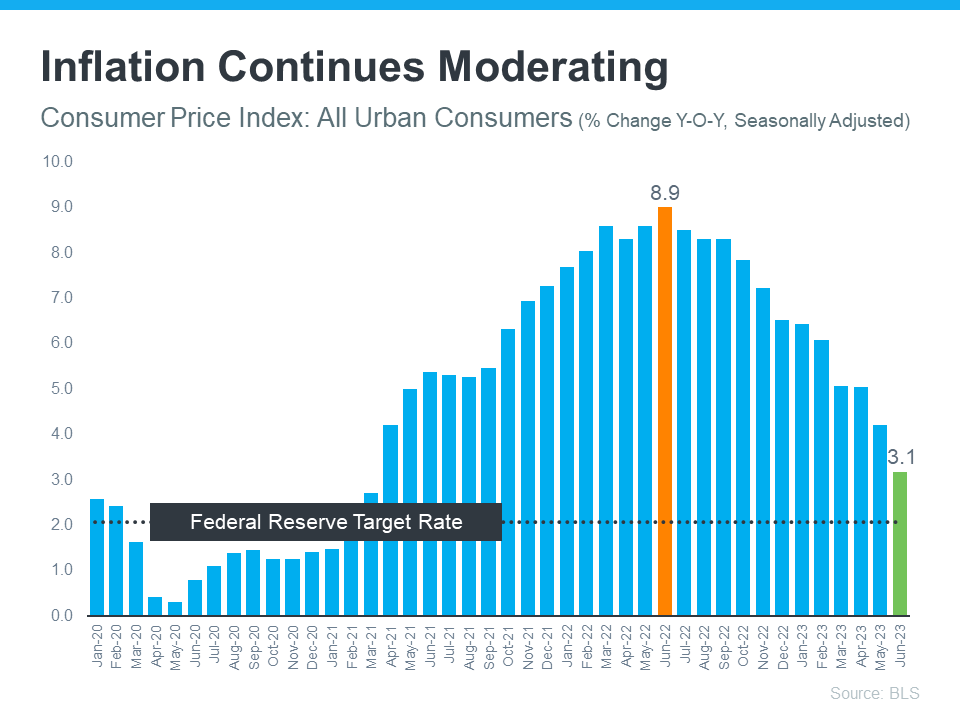

The Fed is trying hard to reduce inflation. And even though there’s been 12 straight months where inflation has cooled (see graph below), the most recent data shows it’s still higher than the Fed’s target of 2%:

While you may have been hoping the Fed would stop their hikes since they’re making progress on their goal of bringing down inflation, they don’t want to stop too soon, and risk inflation climbing back up as a result. Because of this, the Fed decided to increase the Federal Funds Rate again last week. As Jerome Powell, Chairman of the Fed, says:

“We remain committed to bringing inflation back to our 2 percent goal and to keeping longer-term inflation expectations well anchored.”

Greg McBride, Senior VP, and Chief Financial Analyst at Bankrate, explains how high inflation and a strong economy play into the Fed’s recent decision:

“Inflation remains stubbornly high. The economy has been remarkably resilient, the labor market is still robust, but that may be contributing to the stubbornly high inflation. So, Fed has to pump the brakes a bit more.”

Even though a Federal Fund Rate hike by the Fed doesn’t directly dictate what happens with mortgage rates, it does have an impact. As a recent article from Fortune says:

“The federal funds rate is an interest rate that banks charge other banks when they lend one another money . . . When inflation is running high, the Fed will increase rates to increase the cost of borrowing and slow down the economy. When it’s too low, they’ll lower rates to stimulate the economy and get things moving again.”

How All of This Affects You

In the simplest sense, when inflation is high, mortgage rates are also high. But, if the Fed succeeds in bringing down inflation, it could ultimately lead to lower mortgage rates, making it more affordable for you to buy a home.

This graph helps illustrate that point by showing that when inflation decreases, mortgage rates typically go down, too (see graph below):

As the data above shows, inflation (shown in the blue trend line) is slowly coming down and, based on historical trends, mortgage rates (shown in the green trend line) are likely to follow. McBride says this about the future of mortgage rates:

“With the backdrop of easing inflation pressures, we should see more consistent declines in mortgage rates as the year progresses, particularly if the economy and labor market slow noticeably.”

Bottom Line

What happens to mortgage rates depends on inflation. If inflation cools down, mortgage rates should go down too. Let’s talk so you can get expert advice on housing market changes and what they mean for you.

Filed under Mortgage Info

Borrowers rush to get the last of the low mortgage rates, with refinances jumping 18%

Mortgage rates continued to surge higher last week, and that brought borrowers out of the woodwork, looking to refinance. While that might seem counterintuitive, given the higher rates, there are still a significant number of borrowers who could benefit from a refinance, and they may have been worried that this was their last chance.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 3.78% from 3.72%, with points decreasing to 0.41 from 0.43 (including the origination fee) for loans with a 20% down payment, according to the Mortgage Bankers Association. That was the highest rate since March 2020. One year ago, the rate was 86 basis points lower.

With rates now clearly on the upward trajectory, mortgage applications to refinance a home loan jumped 18% week to week, seasonally adjusted. Volume was still 50% lower than the same week one year ago. The refinance share of mortgage activity increased to 57.3% of total applications from 55.8% the previous week.

Homebuyers rush to buy before interest rates rise again

Mortgage rates sat near record lows for the better part of last year, but not everyone who could benefit refinanced. As of now, roughly 5.9 million borrowers could still save enough to make the process worth it, according to a recent analysis by Black Knight, a mortgage technology and data provider. That number was about 11 million at the start of this year and as high as nearly 20 million in late 2020.

“There has likely been some recent volatility in application counts due to holiday-impacted weeks, as well as from borrowers trying to secure a refinance before rates go even higher,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting.

Mortgage applications to purchase a home increased 4% for the week but were 7% lower than the same week one year ago. Buyers have been uncharacteristically busy this January, with some concerned that rising rates will price them out of the already expensive housing market by spring.

Anecdotally, real estate agents say they could easily have more sales if there were more listings. The current supply of homes for sale is at a record low, with inventory especially lean at the lower end of the market. That’s why most of the activity is now at the higher end.

“The average purchase loan size hit a new survey high once again at $441,100. Stubbornly low inventory levels and swift home-price growth continue to push average loan sizes higher,” Kan said.

cnbc 2/2/2022

Filed under Real Estate (Market info)

Owning Is More Affordable than Renting in the Majority of the Country

If you were thinking about buying a home this year, but already pressed pause on your plans due to rising home prices and increasing mortgage rates, there’s something you should consider. According to the latest report from ATTOM Data, owning a home is more affordable than renting in the majority of the country.

The 2022 Rental Affordability Report says:

“. . . Owning a median-priced home is more affordable than the average rent on a three-bedroom property in 666, or 58 percent, of the 1,154 U.S. counties analyzed for the report. That means major home ownership expenses consume a smaller portion of average local wages than renting.”

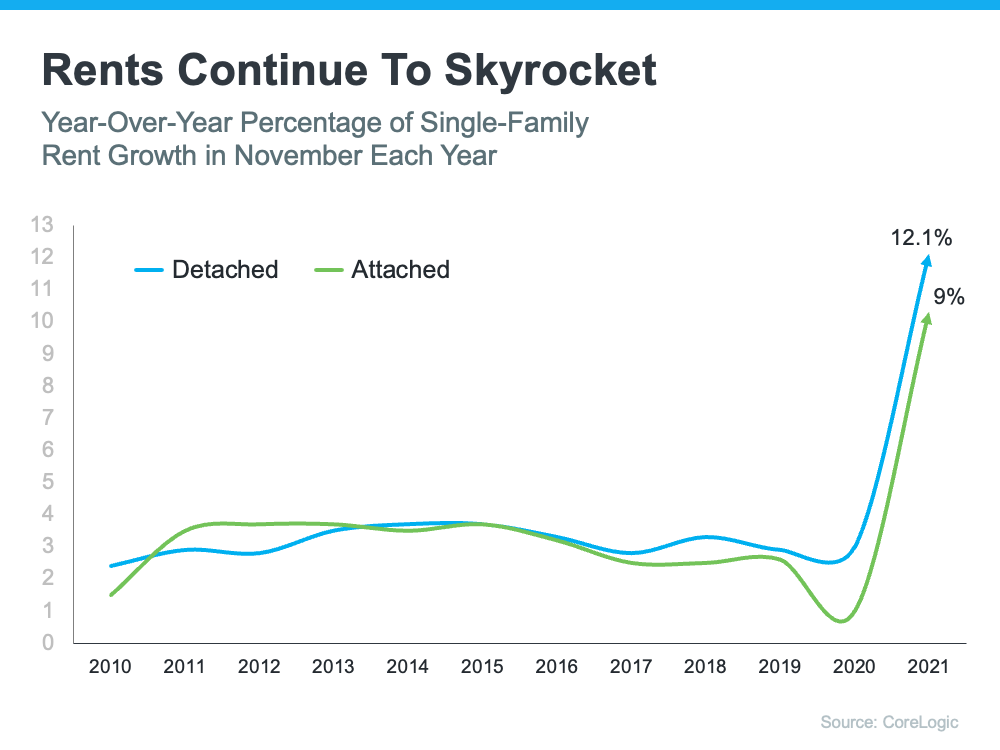

Other experts in the industry offer additional perspectives on renting today. In the latest Single-Family Rent Index from CoreLogic, single-family rent saw the fastest year-over-year growth in over 16 years when comparing data for November each year (see graph below):

Molly Boesel, Principal Economist at CoreLogic, stresses the importance of what the data shows:

“Single-family rent growth hit its sixth consecutive record high. . . . Annual rent growth . . . was more than three times that of a year earlier. Rent growth should continue to be robust in the near term, especially as the labor market continues to improve.”

What Does This Mean for You?

While it’s true home prices and mortgage rates are rising, so are monthly rents. As a prospective buyer, rising rates and prices shouldn’t be enough to keep you on the sideline, though. As the chart above shows, rents are skyrocketing. The big difference is, when you rent, that rising cost benefits your landlord’s investment strategy, but it doesn’t deliver any sort of return for you.

In contrast, when you buy a home, your monthly mortgage payment serves as a form of forced savings. Over time, as you pay down your loan and as home values rise, you’re building equity (and by extension, your own net worth). Not to mention, you’ll lock in your mortgage payment for the duration of your loan (typically 15 to 30 years) and give yourself a stable and reliable monthly payment.

When asking yourself if you should keep renting or if it’s time to buy, think about what Todd Teta, Chief Product Officer at ATTOM Data, says:

“. . . Home ownership still remains the more affordable option for average workers in a majority of the country because it still takes up a smaller portion of their pay.”

If buying takes up a smaller portion of your pay and has benefits renting can’t provide, the question really becomes: is renting really worth it?

Bottom Line

If you’re weighing your options between renting and buying, it’s important to look at the full picture. While buying a home can feel like a daunting process, having a trusted advisor on your side is key. Let’s connect to explore your options so you can learn more about the benefits of homeownership today.

Filed under Real Estate (Market info)

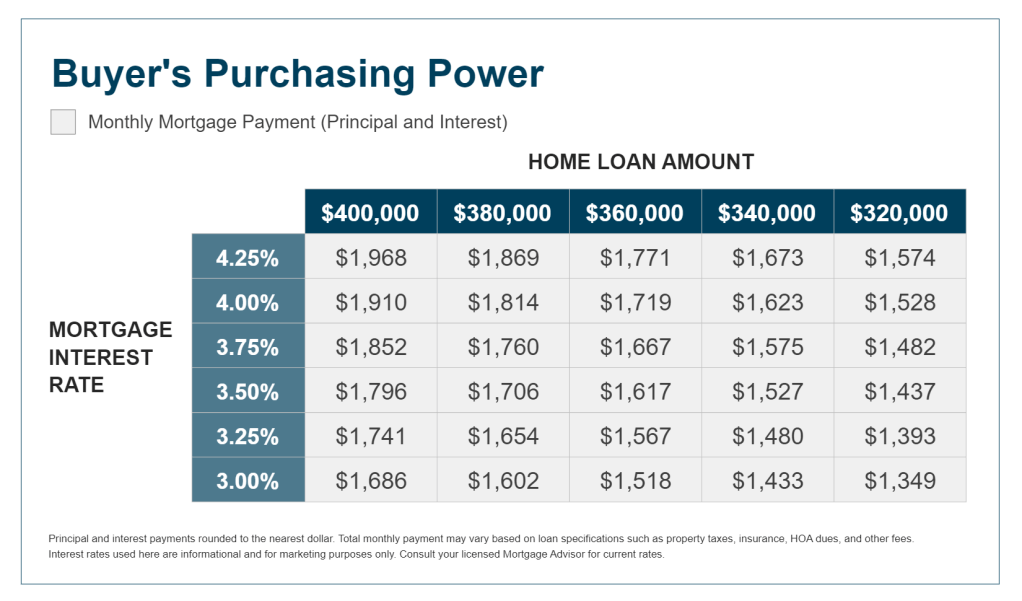

Interest Rate Affect On Payment

This chart shows how 1.25 % increase in rate could affect monthly principal and interest payment. For Example; the P&I payment on $400,000 at a rate of 3% is $1,686 per month but that same price calculated with a 4.25 % rate is $1,968 per month. A difference of $282 per month.

Filed under Real Estate (Market info)

Why Right Now Is a Once-in-a-Lifetime Opportunity for Sellers

If you’re thinking about selling your house in 2022, you truly have a once-in-a-lifetime opportunity at your fingertips.

When selling anything, you always hope for strong demand for the item coupled with a limited supply. That maximizes your leverage when you’re negotiating the sale. Home sellers are in that exact situation right now. Here’s why.

Demand Is Very Strong

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), 6.18 million homes were sold in 2021. This was the largest number of home sales in 15 years. Lawrence Yun, Chief Economist for NAR, explains:

“Sales for the entire year finished strong, reaching the highest annual level since 2006. . . . With mortgage rates expected to rise in 2022, it’s likely that a portion of December buyers were intent on avoiding the inevitable rate increases.”

Demand isn’t expected to weaken this year, either. In addition, the Mortgage Finance Forecast, published last week by the Mortgage Bankers’ Association (MBA), calls for existing-home sales to reach 6.4 million homes this year.

Supply Is Very Limited

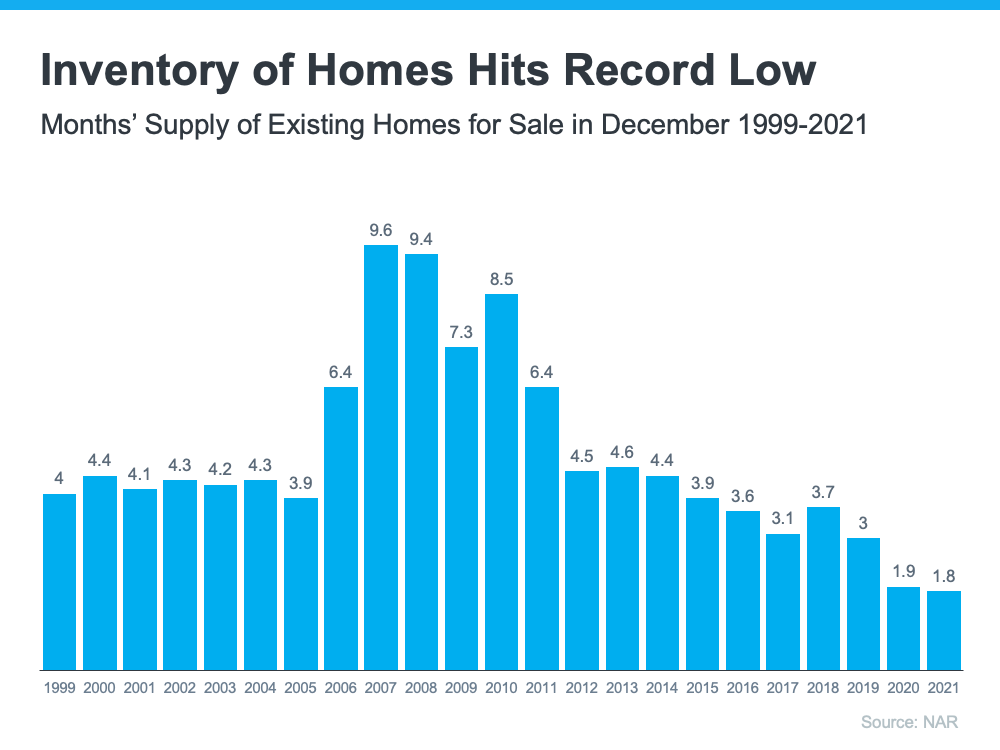

The same sales report from NAR also reveals the months’ supply of inventory just hit the lowest number of the century. It notes:

“Total housing inventory at the end of December amounted to 910,000 units, down 18% from November and down 14.2% from one year ago (1.06 million). Unsold inventory sits at a 1.8-month supply at the present sales pace, down from 2.1 months in November and from 1.9 months in December 2020.”

The reality is, inventory decreases every year in December. That’s just how the typical seasonal trend goes in real estate. However, the following graph emphasizes how this December was lower than any other December going all the way back to 1999.

Right Now, Sellers Have Maximum Leverage

As mentioned above, when there’s strong demand for an item and a limited supply of it available, the seller has maximum leverage in the negotiation. In the case of homeowners who are thinking about selling, there may never be a better time than right now. While demand is this high and inventory is this low, you’ll have leverage in all aspects of the sale of your house.

Today’s buyers know they need to be flexible negotiators that make very competitive offers, so here are a few areas that could tip in your favor when your house goes on the market:

- Competitive sales price

- Flexible closing date

- Potential for a leaseback to allow you more time to find a home

- Minimal offer contingencies

Bottom Line

If you’re thinking of selling your house this year, now is the optimal time to list it. Let’s connect to discuss how you can put your house on the market today.

Filed under Real Estate (Market info)

Price increase 16.6% in 12 months – Charleston SC Area Real Estate.

Prices grew 16.6% in 12 months according to the stats recorded by our Local MLS, Charleston-Trident Association of Realtors. In January of 2021. The median sales price was documented at just under $305,000 and by January of 2022 the median sales price was $353,000, up 16.6%.

Filed under Market Statistics, Real Estate (Market info)