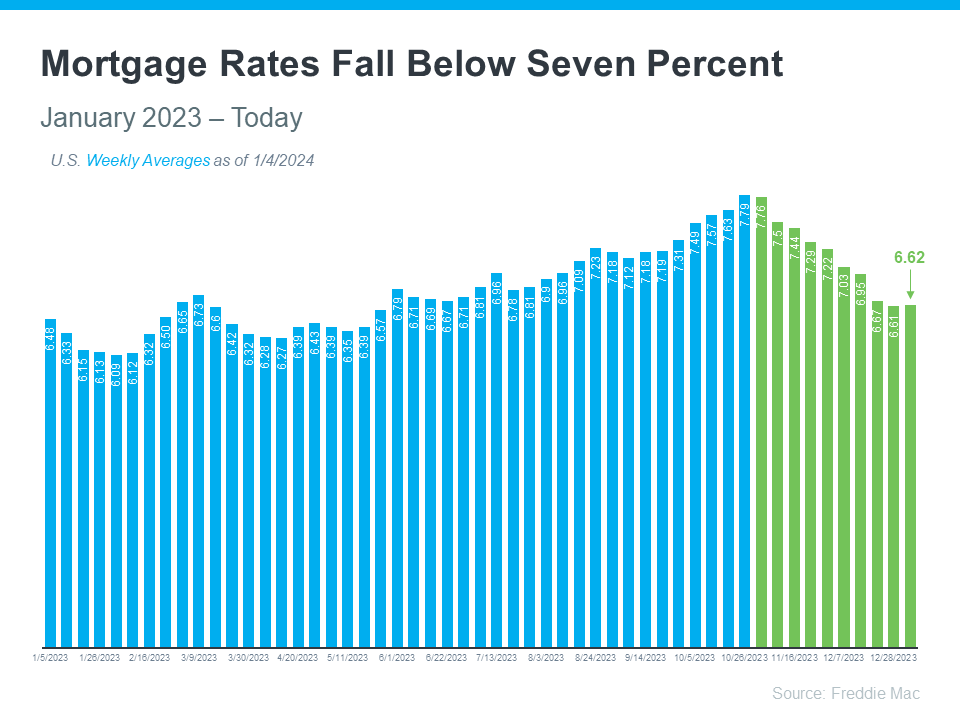

If you want to buy a home, it’s important to know how mortgage rates impact what you can afford and how much you’ll pay each month. Fortunately, rates for 30-year fixed mortgages have come down significantly since the end of October and are currently under 7%, according to Freddie Mac (see graph below) and many analysts predict a continued easing of mortgages rates throughout 2024.

This recent trend is great news for buyers. As a recent article from Bankrate says:

“The rate cool-off somewhat eases the housing affordability squeeze.”

And according to Edward Seiler, AVP of Housing Economics and Executive Director of the Research Institute for Housing America at the Mortgage Bankers Association (MBA):

“MBA expects that affordability conditions will continue to improve as mortgage rates decline . . .”

Here’s a bit more context on how this could help with your plans to buy a home.

How Mortgage Rates Affect Your Search for a Home

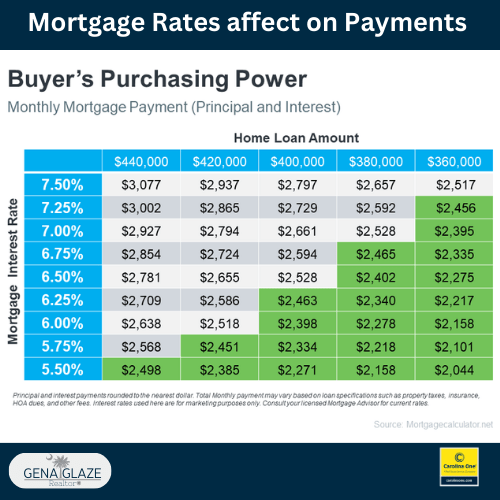

Understanding the connection between mortgage rates and your monthly home payment is crucial for understanding the sales price you can afford. The chart below illustrates how your ability to afford a home changes when mortgage rates shift. (see chart below):

More information about interest rates at Freddie Mac