The National Association of Realtor’s economists recently weighed in on home sales, mortgage rates, the economy and changing buyer demographics and its effect on real estate for the year ahead.

Lawrence Yun, chief economist of the National Association of REALTORS®, along with NAR’s Deputy Chief Economist, Jessica Lautz, shared data and forecasts..

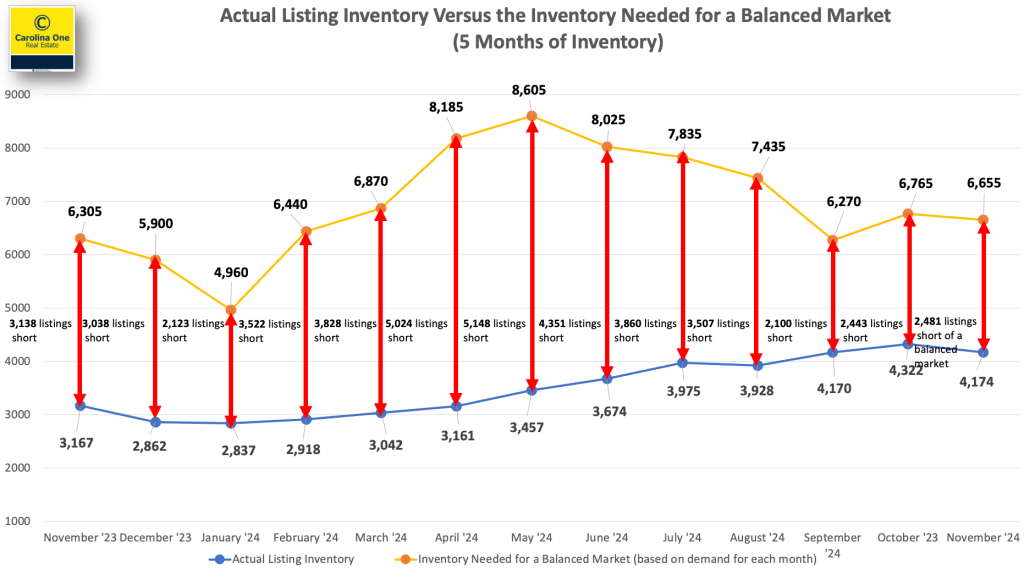

Their updated estimates show that the housing market is still dramatically undersupplied, and they estimate that U.S. housing stock is 3.7 million units below what is needed.

High mortgage rates and rising home prices have put a damper on affordability and are directly related to the supply shortage. Building more houses is essential but builders are also contending with high interest rates.

There is no silver bullet to alleviating this ongoing shortage but there are options being considered such as, accessory dwelling units (ADUs), Community Land Trusts, condominium conversions, and manufactured homes. They will continue to study this topic and work to uncover potential solutions.

Yun released a rosier forecast for the housing market for 2025 and 2026, with an outlook for higher home sales and moderating mortgage rates.

Here’s an overview of NAR’s predictions on key housing indicators for the year ahead.

Home Sales to Rise

With improving job numbers and recent gains in the stock market, more Americans may be motivated to act, Yun said.

Here’s Yun’s forecast over the next two years:

- 2025 sales projection: Existing home sales to rise 9% year-over-year; New home sales to jump by 11%.

- 2026 sales projection: Existing-home sales to rise 13% year-over-year; new home sales to increase by 8%.

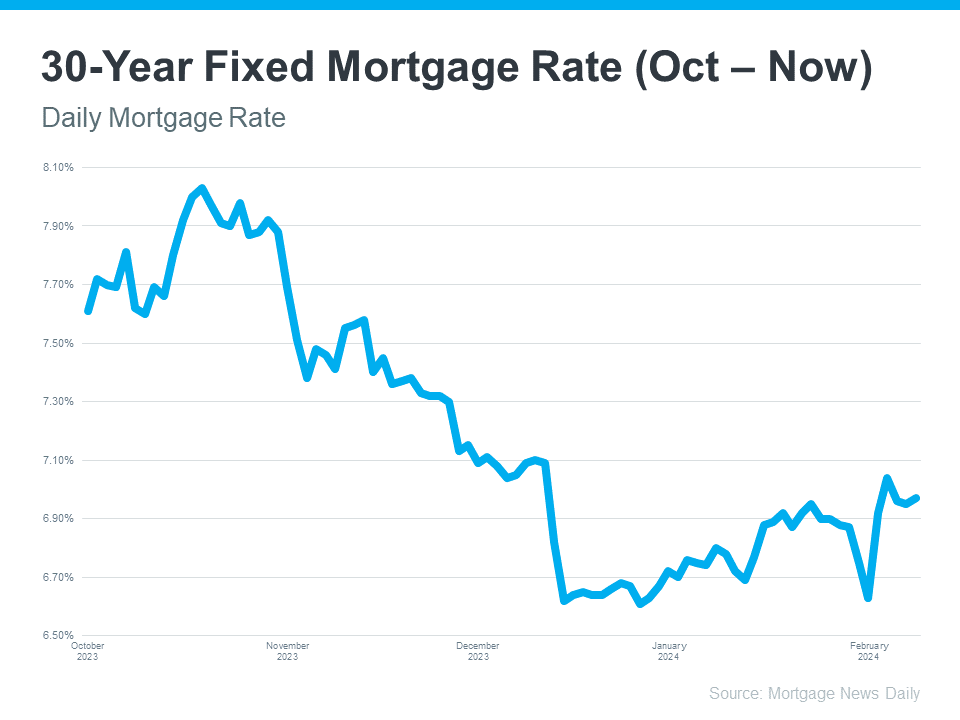

Mortgage Rates to Moderate

The trajectory of mortgage rates will have a major bearing on how the housing market will fare, Yun said.

Mortgage rates may moderate but buyers may not see that anytime soon, Yun said. “Mortgage rates will not decline in tandem”… “With a large budget deficit, there’s less mortgage money available…. A large budget deficit will prevent mortgage rates from going down to 4%”

Nevertheless, the “locked-in” effect of homeowners feeling stuck-in-place with low 2% or 3% mortgage rates from recent years will lessen over time, as personal milestones (births, deaths, marriages, graduations, new jobs,etc.) trigger real estate moves.

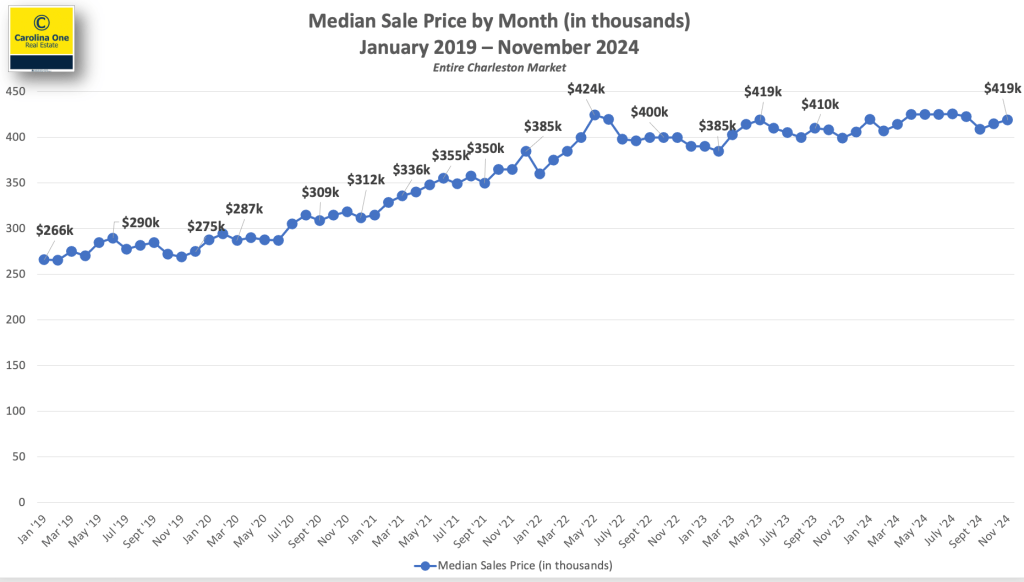

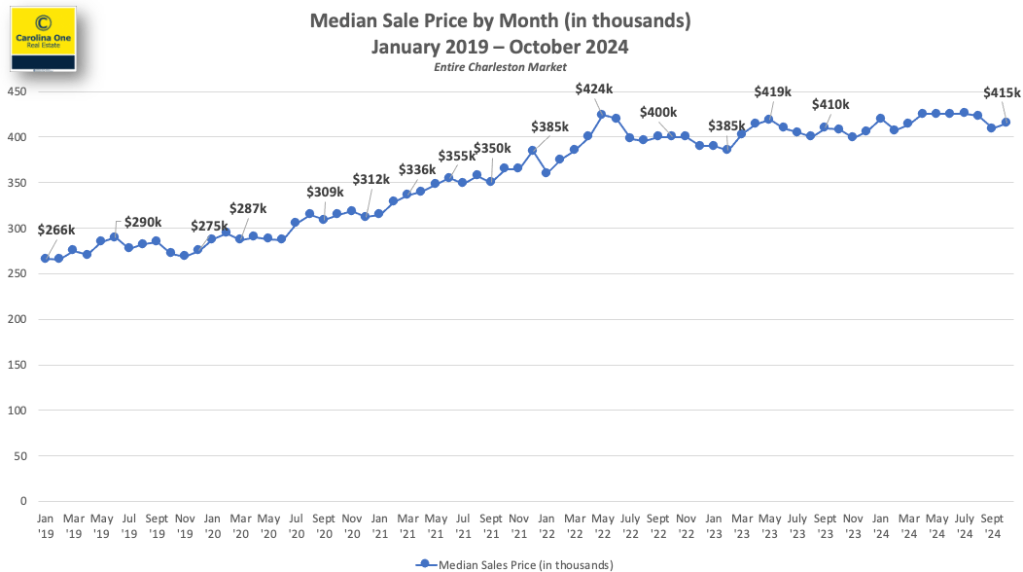

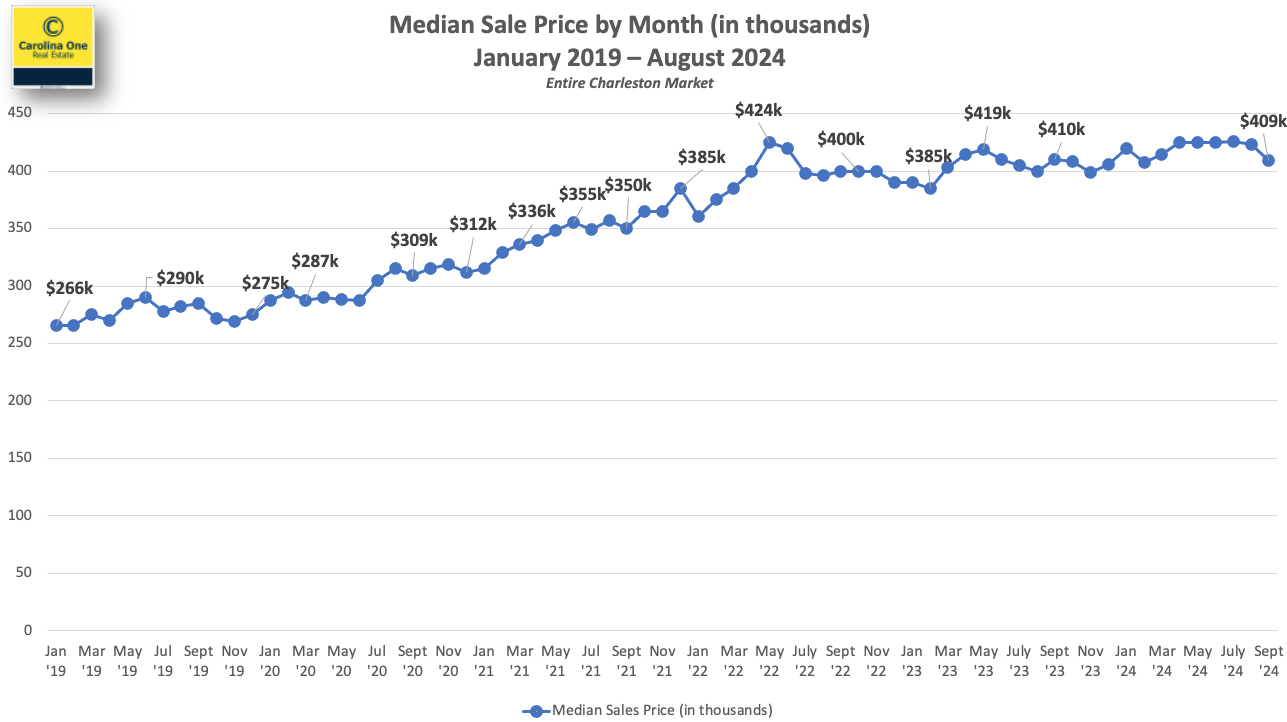

Home Prices Increases Slowly After Rapid Rises

While homeowners have enjoyed record-breaking equity gains, home buyers’ have been struggling with affordability. A typical homeowner has accumulated $147,000 in housing wealth just over the last five years, according to NAR’s research. As a result, the spread in median net worth between homeowners and renters continues to grow. It stands at $415,000 for homeowners versus $10,000 for renters, Yun said.

“The strong price increases cannot be sustainable for another five years, or America will be divided … with only a few getting to experience the tremendous housing wealth,” Yun said. “If we bring more supply to the housing market, home price increases will not be as outrageous … and will be more in line with wages.”

Yun’s forecast:

- 2025 median home price: $410,700; up 2% over 2024.

- 2026 median home price: $420,000, up 2% over 2025.

A Different Type of Buyer Emerges

The profile of home buyers are changing, Lautz said, presenting data from NAR’s newly released 2024 Profile of Home Buyers and Sellers. Here’s a few of the changes observed in the report:

- More buyers are skipping the mortgage. all-cash buyers have surged to record highs, accounting for 26% of home sales over the past year. Thirty-one percent of repeat buyers paid all-cash for their next home purchase.

- First-time buyers are getting older. The median age of a first-time home buyer was 38, an all-time high. Twenty-five percent of first-time buyers used a gift or loan from a relative or friend for their home purchase; 20% took money out of financial assets like stocks, 401ks or cryptocurrency to afford homeownership; and 7% used inheritance money for their purchase—a record high, Lautz noted. First-time buyers are coming up with the highest down payments in nearly 30 years—at 9%—in order to afford the higher home prices.

- The allure of cities grows. The pandemic may have unleashed a trend of suburban movers, but people are now heading back to city centers—the largest uptick in a decade, Lautz said.

- More buyers are pooling their money. The number of multigenerational households surged to an all-time high of 17% over the past year. “The number one reason is for cost savings,” Lautz said. “They’re combining incomes” in order to afford homeownership. They’re also buying a multigenerational home to take care of aging parents or because of young adults are moving back home, Lautz noted.

- Single women buyers continue to outpace single men buyers. A drop in marriage rates has triggered more consumers to enter the housing market on their own. Single women held a 24% share of the home-purchase market over the past year. For single men, it was 11%.