CLOSED SALES – There were1,088 closed sales in January of 2026, up 3.2.% from January of 2025

SALES PRICE – The median sales price closed out at $417,422 up +0.3% year-over-year, and the average sales price for January 2026 was $707,670

PRICE PER SQFT – The average price per sqft for all residential property types was at $311 | up +4.7%

NEW WRITTEN SALES (Pending) – There were 1,536 new written sales in January 2026, up + 17.8% This is an indicator of future closed sales – a good start for 2026!

INVENTORY – Approximately 2,299 new listings (all property types) came online in January of 2026, which is upc+19.2% with the average Days on Market at 58, up +16% and 3.2 months of inventory.

NEW CONSTRUCTION

New construction represents 40% of all pending contracts in the MLS and new construction comprises about 34% of the closings.

- 14% of all closings in Charleston County are new construction

- 38% of all closings in Dorchester County are new construction

- 53% of all closings in Berkeley County are new construction

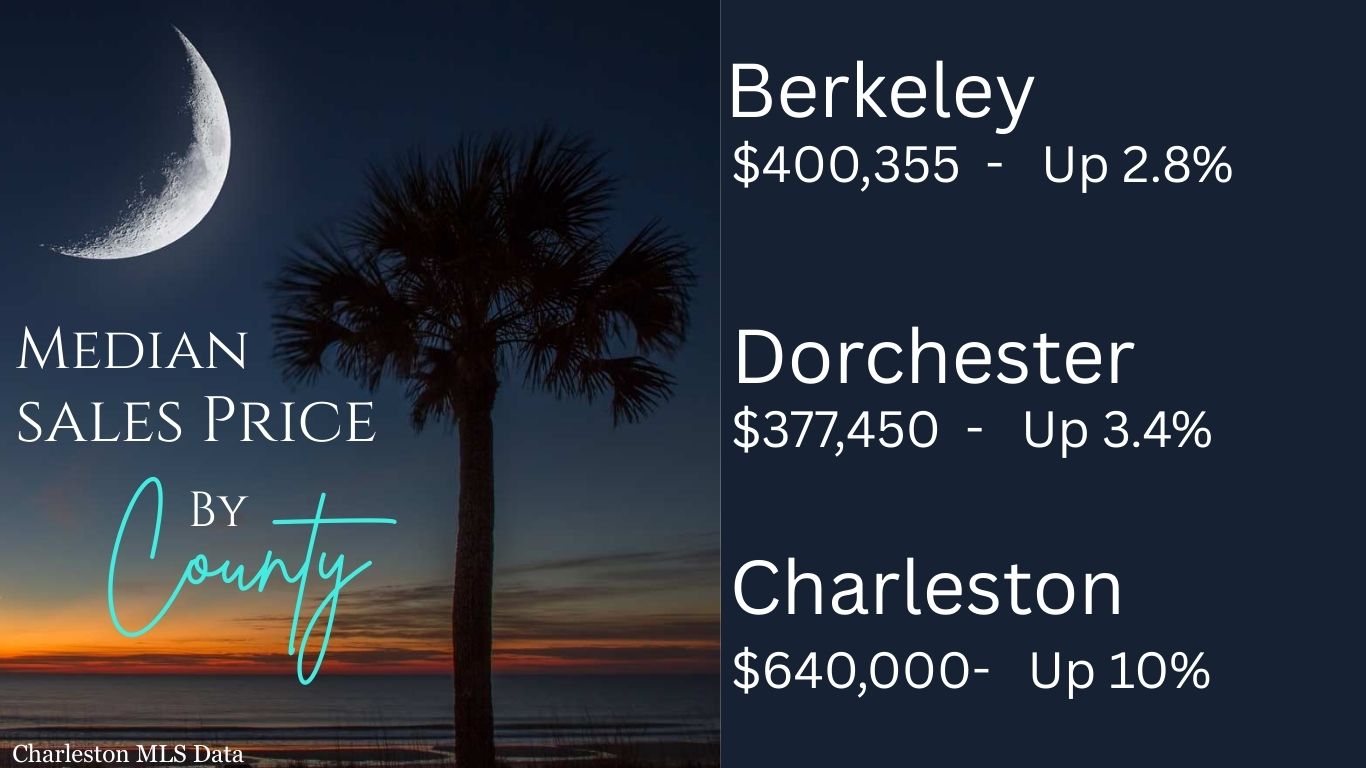

JANUARY MEDIAN SALES PRICE BY COUNTY:

Berkeley County

$395,000 – Up +1.5%

Dorchester County

$367,500 – Down -3.3%

Charleston County

$665,000 – Up +10.8%

Real Estate is Hyper Local. Market statistics vary by location, if you would like a detailed report of your neighborhood and home’s value, feel free to contact me.