The median sales price in the Charleston market for November 2023 was $399,408, down just 0.15% from November 2022. The average days on market for November 2023 was 38 with approximately 2.32 months of inventory.

Gena Glaze

The median sales price in the Charleston market for November 2023 was $399,408, down just 0.15% from November 2022. The average days on market for November 2023 was 38 with approximately 2.32 months of inventory.

Gena Glaze

Filed under Market Statistics, Real Estate (Market info)

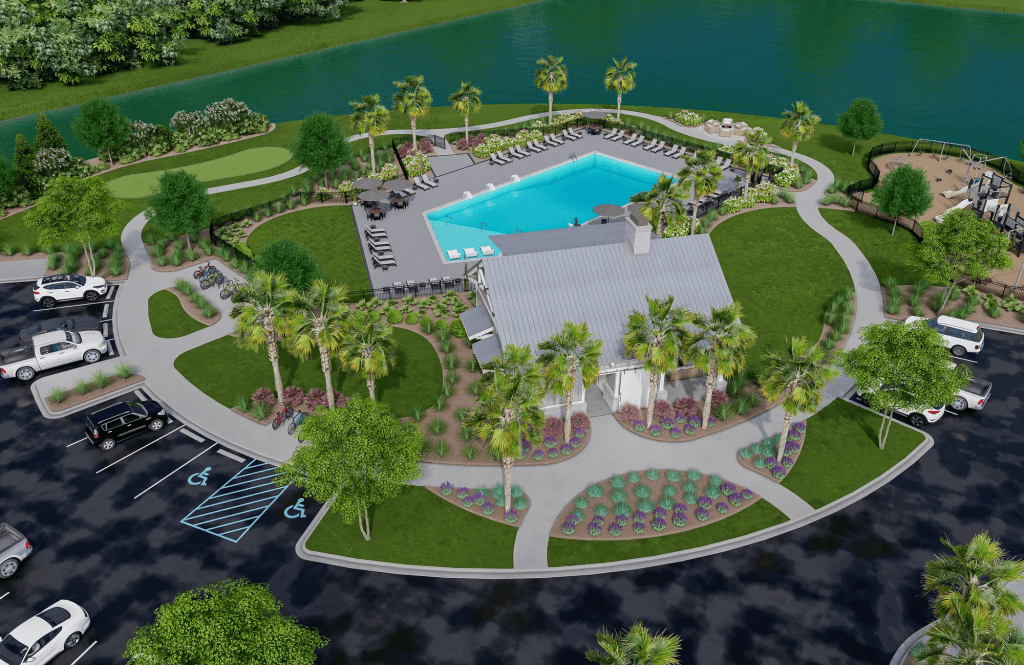

Hewing Farms is a new mungo homes community located in Summerville, SC. adjacent to the master-planned community of Carnes Crossroads right off of Hwy 17-A and only 3 miles from I-26.

The neighborhood offers a variety of community amenities including a cabana, pool, playground, walking trails, oyster shed and putting green.

VIEW ALL HOMES LISTED FOR SALE IN HEWING FARMS

The homes in Hewing Farms are designed with modern features, spacious layouts. There are two distinct Floorplan collections that contain one and two-story, hardi-plank homes that range

from 1,700 to more than 4,330 square feet. Many floorplans feature the primary

bedroom on the first floor, and include a designated home office or bonus room.

The community is conveniently located near shopping, dining, and entertainment options and the Hewing Farms schools are; Cane Bay Elementary, Cane Bay Middle, Cane Bay High School, Carolyn Lewis School

Always verify school attendance zones as they can change without notice.

For more information contact:

Filed under Charleston Area Growth and Development, Places

Housing Bubble?

The “warning signs” look all too familiar.

Escalating home prices have both buyers & sellers worried that the market is just “too good to be true,” and agents across the U.S. are getting bombarded with the ultimate question: “Are we in a housing bubble?”

Let’s take a look at 3 key factors that suggest we’re not, so you can educate your clients and calm fears in your market.

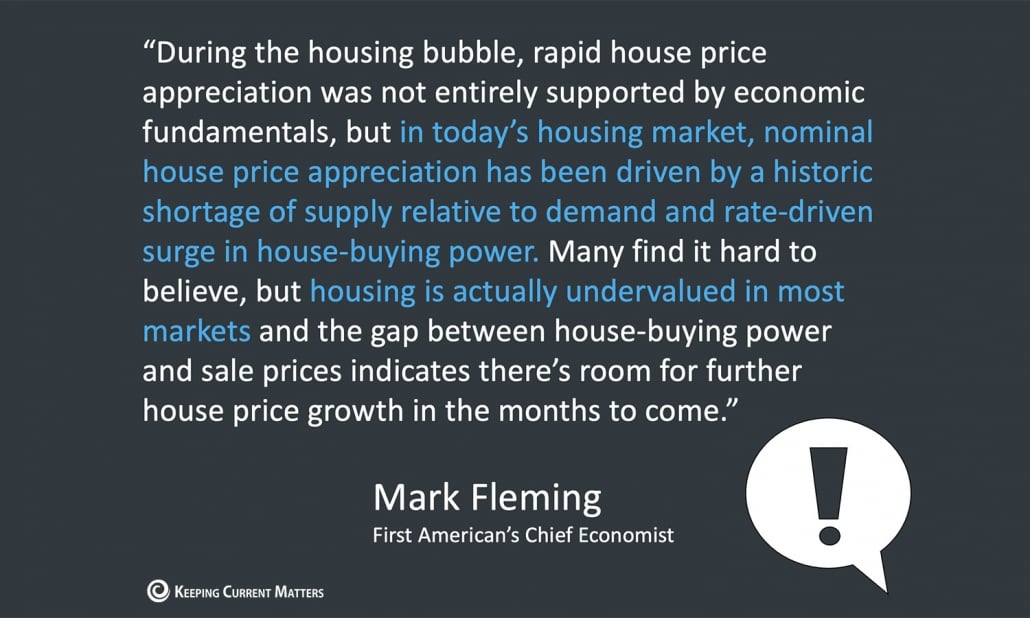

Last year, home values appreciated a whopping 10% on average across the country. And while this year’s growth isn’t expected to match it (experts are predicting closer to 5%), buyers and sellers are still worried that home prices are too high and that depreciation is likely to follow.

However, unlike the Housing Bubble years of the mid-2000s, the major factor driving up home values is that we are also in a dire inventory shortage.

A balanced real estate market’s inventory sits around 6 months. Today’s current market is at 1.9 months, a historically low amount of homes for sale. On top of that, inventory has slowly been declining for years now: we’ve been under 5 months inventory for the last three.

In comparison, the inventory level from 2005 and 2007 increased from 5 months to 11 months, a vast over-supply of homes that did not warrant the price appreciation that went along with it.

So, throwing it back to your high school economics class, the biggest driver of price appreciation is a simple case of supply and demand, hence what we’re seeing in the market today.

If you remember the housing boom of the mid-2000s, you know how crazy that time was in real estate. But if Robert Schiller, a fellow at the Yale School of Management’s International Center for Finance, could sum it up in one phrase, it’s this: irrational exuberance.

In other words, the buying and selling frenzy that in-part caused the market collapse was fueled not by tactful, financial decisions but a country-wide case of FOMO (fear of missing out).

The mortgage industry fed into the frenzy, making it easy for people to obtain home loans much higher than they could afford.

Today’s real estate demand, however, is a very real thing.

Millennials, currently the largest generation in the U.S., are finally ready for homeownership and hitting the market in mass. The health crisis is also challenging homeowners to re-evaluate whether their current home meets their needs, driving more eager buyers into the market.

These two big factors, coupled with historically low mortgage rates, make purchasing a home today a good financial decision. So, not only is the demand very real, it’s also very smart.

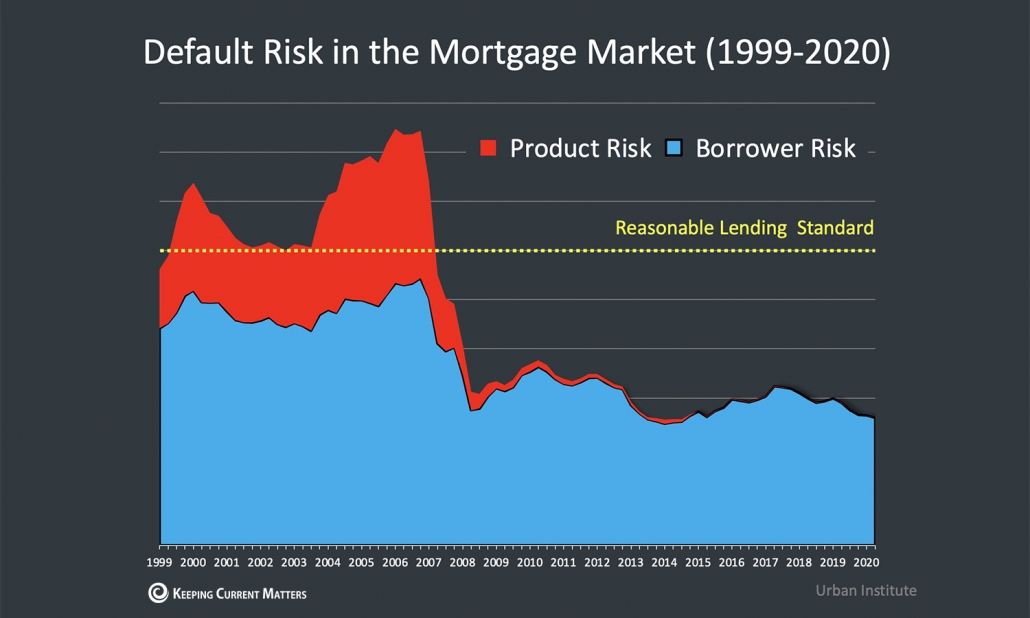

Following the housing and economic crash of 2008, economists, financiers, and real estate industry experts have combed through data to figure out why the entire system crumbled the way it did.

Most will agree that one of the biggest pieces of that catastrophic equation came down to this: equity. Or in reality, a lack of it.

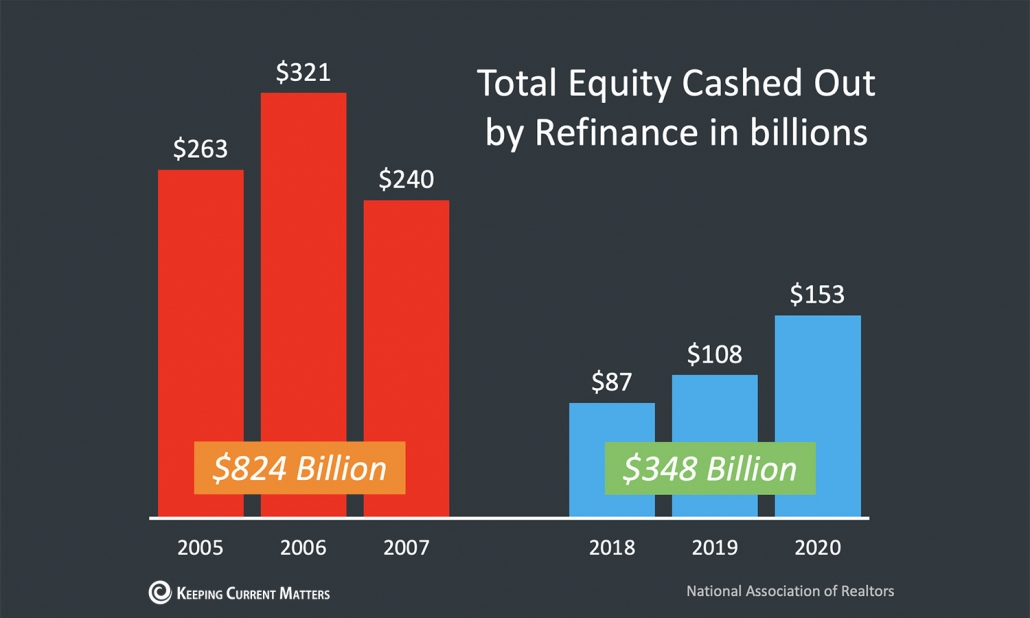

The mid-2000s saw a massive wave of homeowners cashing out the equity in their homes. In short, they were using their homes like ATMs to afford some of the finer things in life.

This led to a lot of negative equity situations: where the amount someone owed on their home was far more than what their house was worth. Many foreclosures and short-sales followed, depreciating home values nationwide.

Today is a much different equity picture. Cash-out refinance volume over the last three years is less than a third of what it was compared to the three years before the crash. More than 38% of homeowners have paid off their mortgage “free and clear,” and another 18.7% have paid off over 50% of their mortgage.

This positive equity perspective puts the current housing market in a much stronger place, minimizing risk of foreclosure and stabilizing home values across the U.S.

Gena Glaze

Filed under Real Estate (Market info)