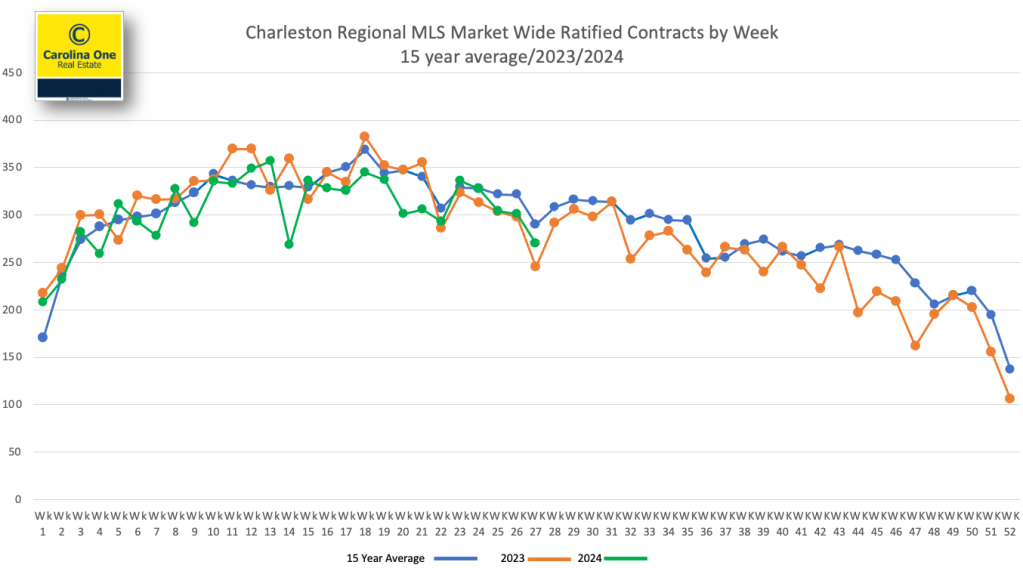

NEW SALES – Pending (Ratified contracts) Down -6% in August of ’24 versus August of ’23. See Chart below – The orange line represents ratified contracts by week last year…the green line is this year…and the blue line is the 15 year average for each week. Follow the green line below.

*written sales (ratified contracts) reflect buyer sentiment and predict the number of closed sales in a month or two as ratified contracts typically close within 4-8 weeks.

CLOSED SALES 149I homes closed in August 2024 down -7.9% from August of 2023

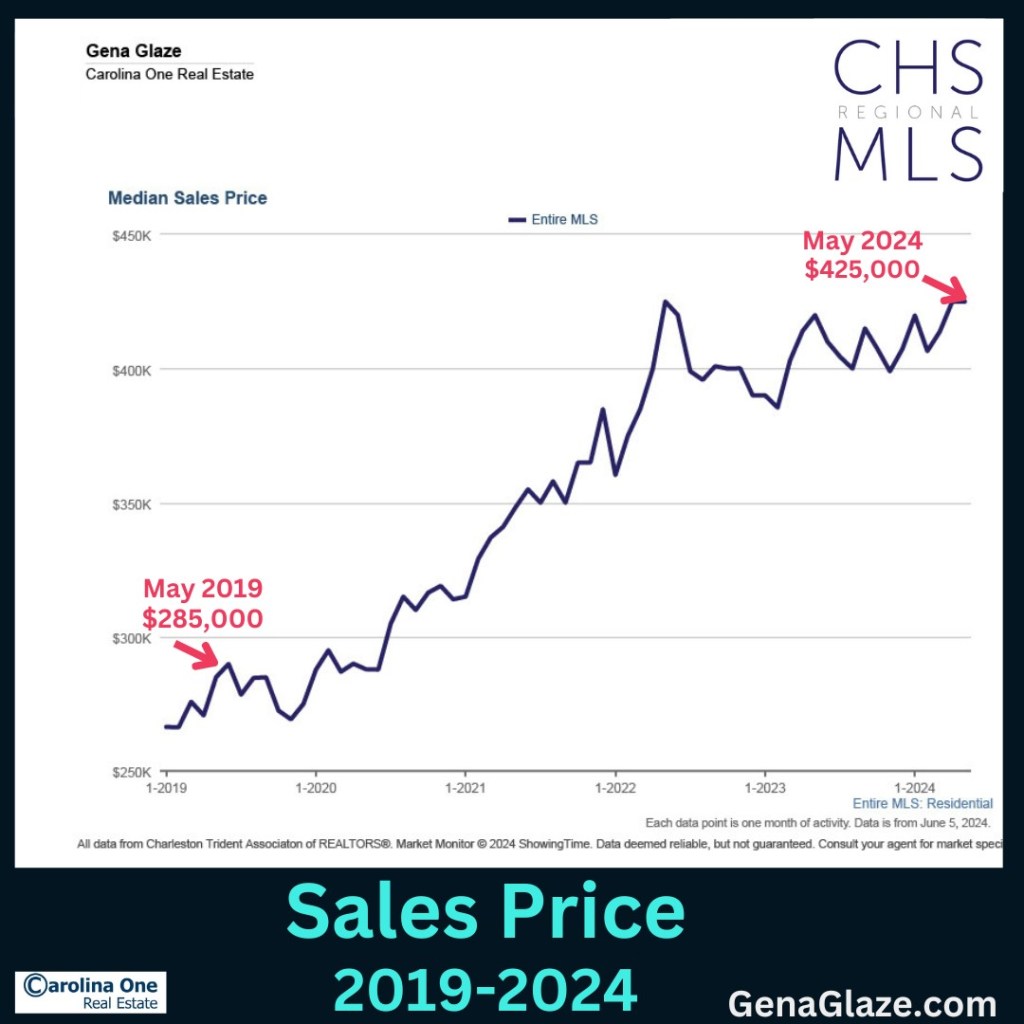

MEDIAN SALES PRICE The Median sale price in the Charleston market $422,670, up 5.67% from August 2023 and has continued to stay in a tight band between $400k and $425k for most of the last 26+ months.

The Average sales price was $617,873, up 11.54% from August of 2024

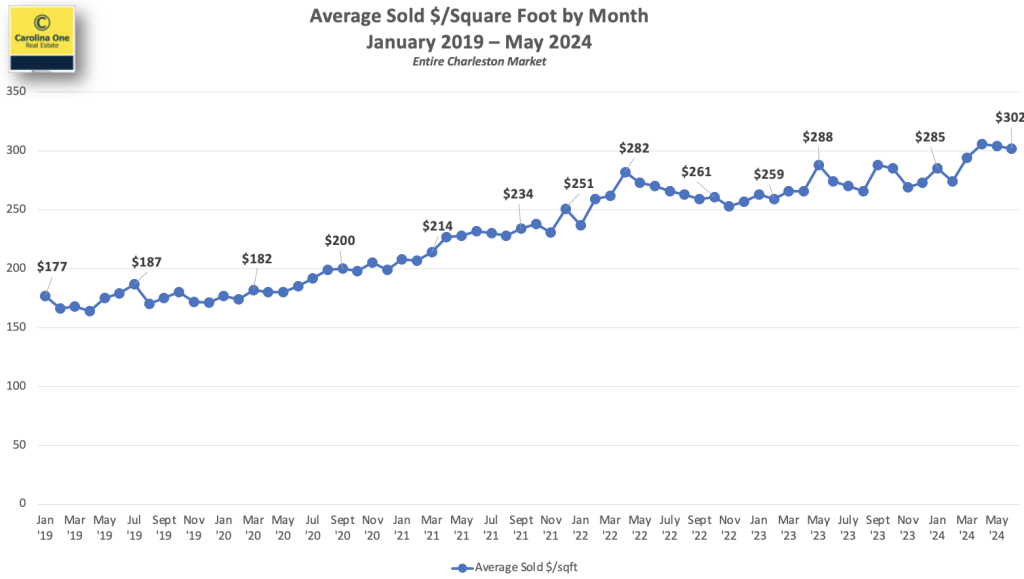

AVERAGE SOLD PRICE PER SQFT While the median sales price is remaining in a tight band, The Average Sold Dollar per sqft remains near an all-time high, at about $291 / SQFT. This means that homes are continuing to appreciate despite a stable median Sale Price

SEASONAL STATS The seasonal surge in median price that is typically experienced in the spring/summer market trended about 6% above last year’s seasonal surge, suggesting that the current pricing in our market has a solid base and given low inventory levels relative to sales, could mean that additional price gains lie ahead.

*Please note that all real estate is local; some local submarkets where there is a lot of new construction in close proximity and similarly priced are seeing prices advance more slowly.

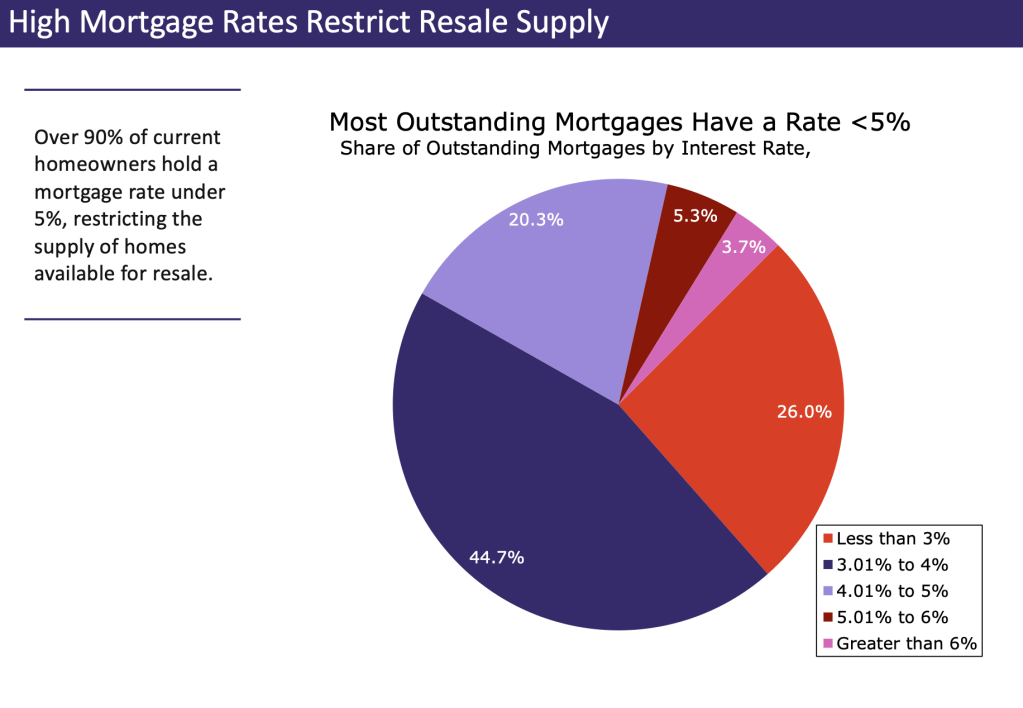

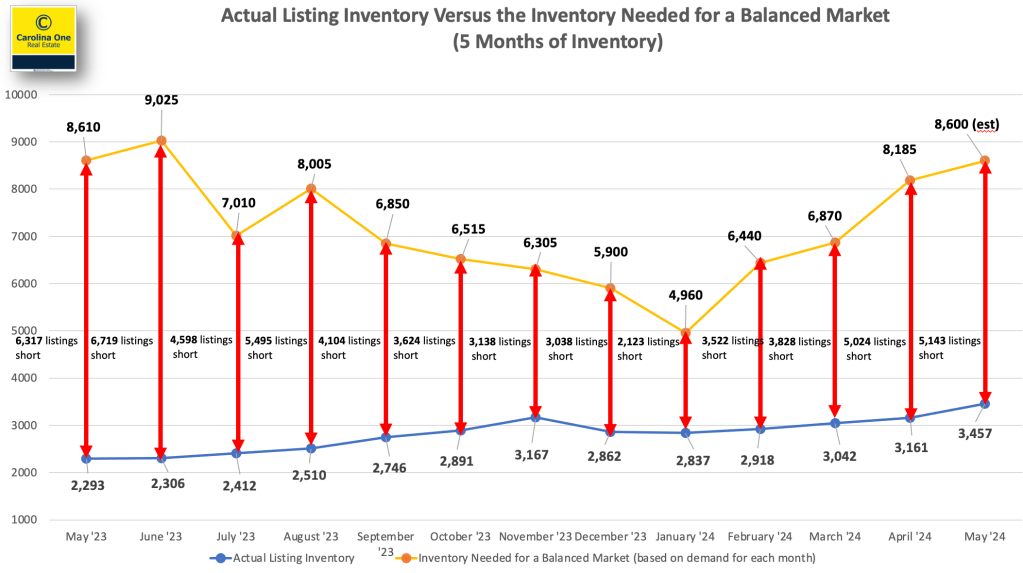

INVENTORY Active Inventory was at approximately 4,000 listings in August, which is a significant increase over the 1,035 listing “floor” that we set in February of 2022. However, we need approximately 3,500 additional listings, market wide, to achieve a balanced market (5 months of inventory). The gap between the number of listings available for sale and the number of listings needed to maintain a balanced market is still substantial. see chart below

Approximately 1,928 new listings came online in August, well ahead of last year’s numbers, which should help drive sales later this year.

The Charleston market has about ten weeks of inventory as a whole, still leaning toward a seller’s market (this varies by price range and specific location). The most active areas have inventory levels are in the 4-6 week range.

NEW CONSTRUCTION New construction represents 45% of all pending contracts in the MLS and comprises about 36% of the closings

FORECLOSURES AND SHORT SALES Foreclosures and Short Sale combined are at 0.9% of all available listings. This is down from 1.8% of all available listings on 1/1/2020. This are very few “newly distressed” properties in the pipeline.

Record home equity is driving the historically low delinquency rate along with high levels of employment. Homeowners do not want to lose their equity.

MILLION DOLLAR PLUS MARKET We are at roughly double the monthly pre-pandemic sales levels of $1MM+ properties. This market segment remains robust.

If you would like more market information or have a real estate need, don’t hesitate to contact me!

—