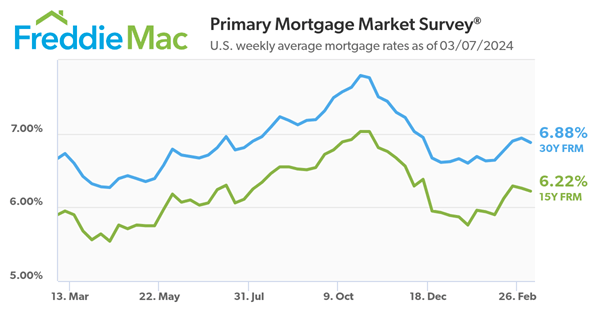

Freddie Mac reports the 30-year FRM averaged 6.88 percent as of March 7, 2024, down from last week when it averaged 6.94 percent. A year ago, at this time, the 30-year FRM averaged 6.73 percent.

As the rates took a small dip, mortgage applications rose, evidence that purchase demand remains sensitive to interest rate changes. Mortgage rates continue to be one of the biggest hurdles for potential homebuyers looking to enter the market.

SEE FREDDIE MAC RATE AVERAGES HERE

Where are Rates Headed? No one has a crystal ball but here is what some experts are predicting:

- Freddie Mac. With the current stance of monetary policy holding steady, we expect mortgage rates to move sideways, remaining above 6.5% through this quarter and drifting down to about 6% by year’s end.

Fannie Mae Housing Forecast. The 30-year fixed rate mortgage will average 6.3% in Q2 2024 and slowly decline over the year, landing at a Q4 average of 5.9%. - National Association of Realtors chief economist Lawrence Yun. “The budget deficit remains high, and the various inflation metrics remain above the comfort level. That means the mortgage rates will likely be in the 6% to 7% range for most of the year.”

- Mortgage Bankers Association (MBA). MBA’s baseline forecast is for mortgage rates to end 2024 at 6.1% and reach 5.5% at the end of 2025 as Treasury rates decline and the spread narrows.

- Bright MLS chief economist Dr. Lisa Sturtevant. During the early part of the year, expect some bumpiness in rates as new economic data are released and as more buyers get back into the market. However, the overall outlook for mortgage rates in 2024 suggests more rate drops, with Bright MLS forecasts predicting rates to hit 6.2% by the fourth quarter.

If you are considering buying a home and would like help navigating through the process, feel free to contact me.

Discover more from Real Estate Matters in Charleston SC - Gena Glaze

Subscribe to get the latest posts sent to your email.