Here is what is worth knowing today:

(1) Written sales market wide finished 13% less in August of ’23 versus August of ’22.

- It was anticipated that sales would be -15% for the year (versus 2022) with the first half of the year being much worse than -15% and the back half of the year being better than -15%

- Based on interest rates remaining stubbornly and persistently high, we are now anticipating that the second half of the year will be similar to the first half of the year with sales in the -15% year-over-year range

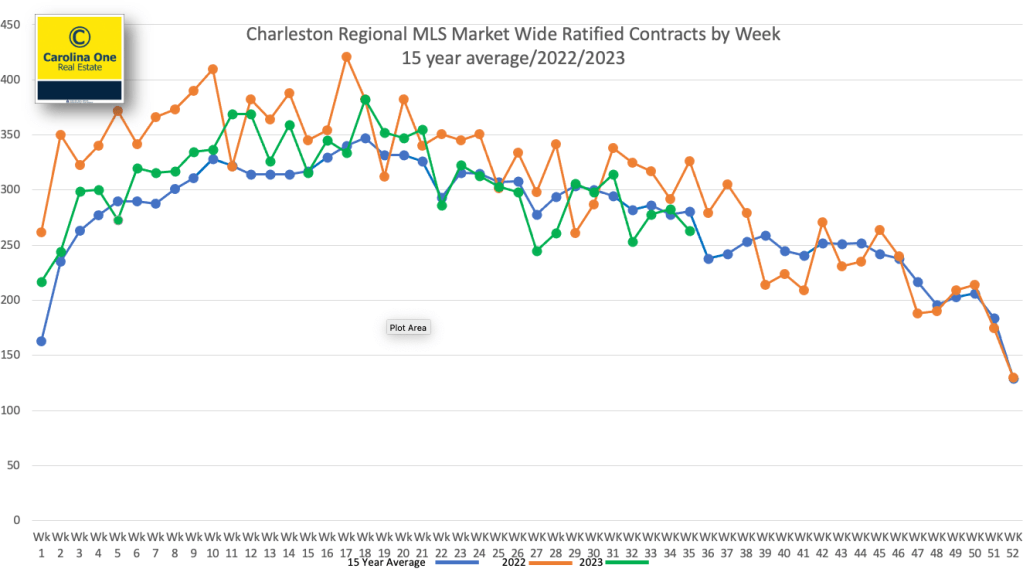

(2) Last week saw 239 properties go under contract, a very “normal” number for this time of year but far below the “juiced up” pandemic years of 2020 and 2021. Sales (green line) have remained remarkably close to the 15 year average (blue line) for about three and a half months.

The orange line represents ratified contracts by week last year…the green line is this year…and the blue line is the 15 year average for each week.

(3) Mortgage rates remaining elevated is holding back sales.

https://fred.stlouisfed.org/series/MORTGAGE30US

4) The Median sale price in the Charleston market continues to stay in a tight band between $400k and $420k where it has been for most of the last 16 months.

(5) Active Inventory stands at 2,510 listings. We haven’t seen much inventory growth this summer and inventory typically starts a slow seasonal decline in September or October. It is believed this may likely put upward pressure on prices, or at the very least hold prices steady.

While this level of inventory is a significant increase over the 1,035 listing “floor” that we set in February of 2022:

- Roughly an additional 5,500 listings is needed market wide to achieve a balanced market (5 months of inventory)

- The gap between the number of listings available for sale and the number of listings needed to maintain a balanced market is substantial. The chart below is an attempt to express this visually.

(6) The number of new listings taken in August was even with the same month a year prior for the first time in two years, but inventory still remains low.

7) The Charleston market has about six or seven weeks of inventory as a whole, still solidly a seller’s market (this can vary by price range and specific location). The most active areas have inventory levels in the 3-6 week range.

(8) New construction represents 46% of all pending contracts in the MLS and new construction comprises about 32% of the closings.

- New Homes “pendings” will always be higher than new homes closings as new construction typically sits in pending status for far longer than a resale, and the new homes tend to “pile up” in pending status, so new homes actually represent about 32% of the sales market currently

- New homes represent 33% of the available inventory, currently.

(9) Foreclosures and Short Sales continue to hold at a combined .6% of all available listings currently. This is down from 1.8% of all available listings on 1/1/2020. This market has very few “newly distressed” properties in the pipeline.

- “Serious delinquencies fell to the lowest level since August 2006; the July delinquency rate was negligibly higher than the lowest level ever recorded.” – Black Knight Mortgage Monitor statement from two weeks ago.

- Record home equity is driving the low delinquency rate along with high levels of employment.

(10) We are at roughly double the monthly pre-pandemic sales levels of $1MM+ properties. This market segment remains surprisingly robust.

Discover more from Real Estate Matters in Charleston SC - Gena Glaze

Subscribe to get the latest posts sent to your email.